Another eventful week has passed you by in the Wild West world of crypto and Web3. Here’s everything that happened over the last seven days, condensed into an easily digestible wrap up for your reading pleasure in yet another edition of The Chainsaw Weekly Wrap.

This week in Web3

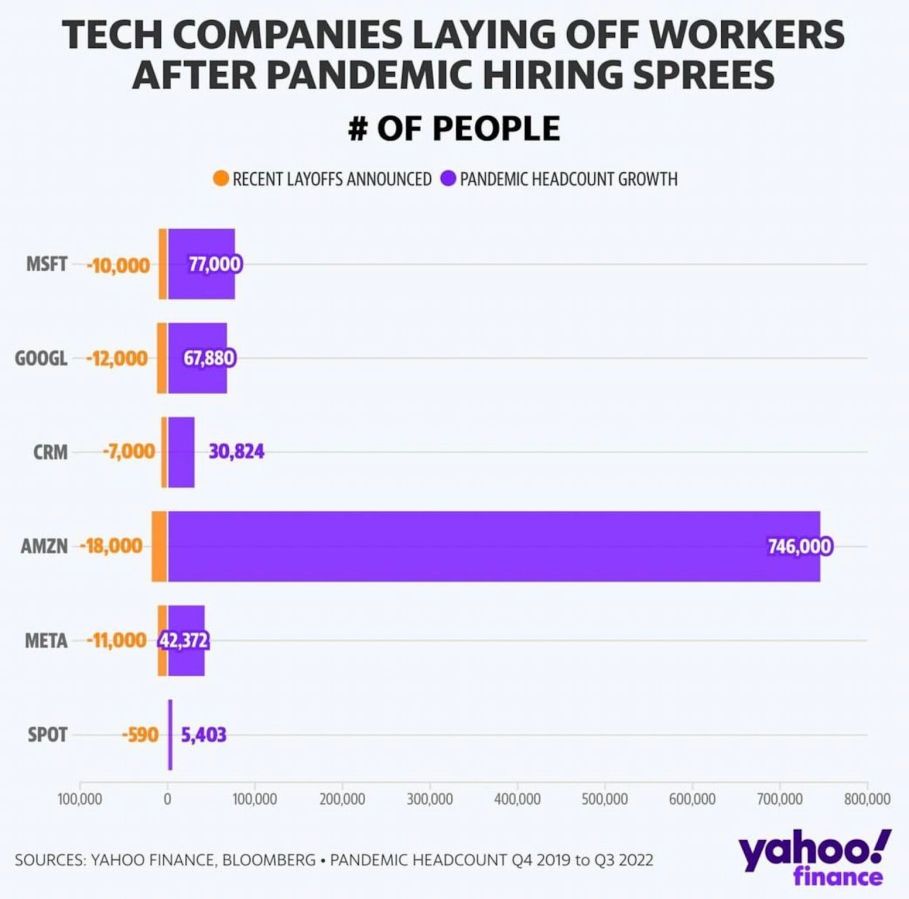

This week kicked off with another round of Big Tech layoffs, this time coming from internet search giant Google which laid off roughly 12,000 staff, almost 6% of its global workforce. The Winklevoss-owned crypto exchange Gemini and music streaming platform Spotify joined the ranks as well, cutting roughly 10% and 6% of their entire workforces respectively.

While the prevailing narrative is one of doom and gloom around the sweeping layoffs throughout both tech and crypto, the size of the layoffs still pale in comparison to the number of new hires made by these companies over the course of the last two years.

Marketing expert Tom Goodwin said that while this data presents a slightly different story to the headlines warning of an impending tech collapse, it also reveals some terrible planning from tech companies that increased their headcount drastically, assuming that Covid-induced conditions would be the ‘new normal’.

All things ChatGPT

Despite laying off around 10,000 employees less than 10 days ago, Microsoft found a spare couple of billion dollars to invest in a multiyear deal with the artificial intelligence (AI) firm behind ChatGPT, Open AI. The multi-billion-dollar investment, estimated to be somewhere in the ballpark of roughly US$10 billion came as schools from around the world begin to crackdown on the viral AI chatbot in attempt to stop students from cheating.

The AI-powered chatbot continued to dominated headlines this week, with ChatGPT passing a Wharton Business School MBA exam. According to researchers, the technology managed to score between a B and B minus on the prestigious school’s final exam. It also passed some parts of the US medical licensing examination, as well as a few multiple choice sections on the bar exam.

Amazon apes into Web3

Just as everyone began to fear the worst for Web3 in the long term, it was revealed today that Amazon will soon be joining the world of crypto, with the launch of a ‘digital assets initiative’ set to be publicly announced in April this year.

According to anonymous sources who spoke with Blockworks, the world’s largest online retailer is looking to experiment with a few different Web3 strategies. The most exciting of these however is reportedly one that will see the integration of blockchain-based games that will reward players with NFTs.

A diamond-handed Elon Musk keeps HODLing Bitcoin

While Tesla investors were pleased that Tesla beat market expectations in its Q4 earnings call, there was reason for Bitcoin investors to be excited as well. The digital assets holdings section of the earnings report confirmed that Tesla still held a total of 10,725 Bitcoin.

Despite beating market expectations, Tesla’s overall performance as a company is still on a downward trend. Gross automotive margins declined to 25%, cash flow was down 36% from Q3 and adjusted earnings per share (EPS) stood at just US$1.19, which is down a little more than down 52% year-over-year.

Remember Fyre Festival? Yeah that guy is back again with another great idea

Billy McFarland, the “entrepreneur” behind the stunning and now-world famous failure that was Fyre Festival, seems committed to pursuing a career in the festival business, even if he just got out of jail for running a fraudulent scheme that became an international Netflix documentary.

This time around, McFarland wants to do it properly, and has now announced the launch of the so-called PYRT festival (which is apparently pronounced “pirate” btw). McFarland seems to think that the best way to do this is through the metaverse, which he strangely says won’t actually be a festival nor will it be an event.

“PYRT is not a festival, it’s not an event, and it’s definitely not a metaverse. PYRT is a technology that I’ve been working on for the past couple of years called the VIDR — the Virtual Immersive Decentralised Reality,” said McFarland in an accompanying promo video.

It’s feels fairly safe to say that he might struggle selling tickets to this one …

Crypto goes up again

On the back of calming inflation data and signals that the US Federal Reserve might finally be slowing down on its policy of seemingly-infinite interest rate hikes, many investors seem to have rediscovered their appetite for risk, funnelling more than US$300 billion back into the crypto market.

While Bitcoin (BTC), Ethereum (ETH) and a number of other cryptocurrencies surged over the course of the last seven days, there’s still fears that crypto’s recent upward pulse may actually be what’s known as a ‘bull trap’. The idea that the rug may be pulled out from underneath the market at any time has led to a good deal of scepticism from crypto investors. Even though many are watching with on from the sidelines with an elevated sense of uncertainty, many experts believe that the bull market might only just be getting started.

Sam Bankman-Fried still has $700M worth of assets to hand over

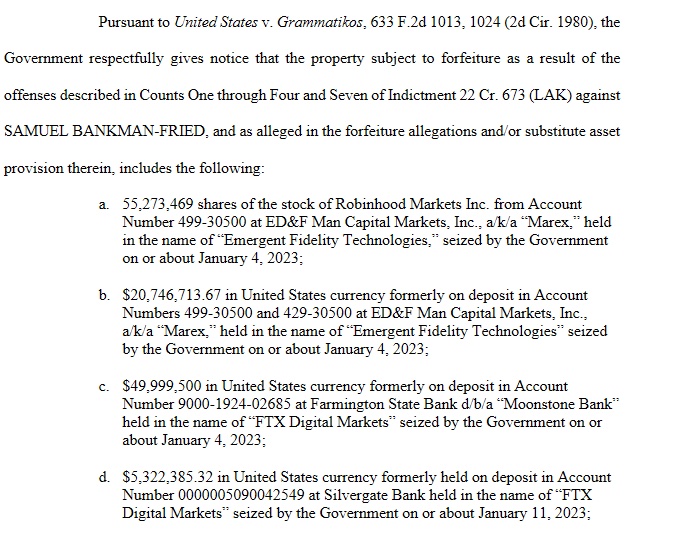

Just when we thought that news of Sam Bankman-Fried (SBF) might have finally come to a temporary end, a new court filing from Federal Prosecutor Damian Williams found that disgraced FTX founder SBF will be forced to forfeit roughly US$700 million worth of assets if he were to be found guilty of fraud.

In a court document filed on January 20, Williams said that Bankman-Fried’s list of forfeitable assets covers a very long list of assets ranging from fiat, shares and crypto.

While SBF’s former associates from FTX, Caroline Ellison and Gary Wang have both plead guilty and have chosen to cooperate with investigators, Bankman-Fried has plead not guilty to the litany of charges being pressed against him. If found guilty on all counts, SBF faces up to 110 years in Federal prison.

North Korea linked to massive hack

While SBF might be public enemy number one right now, its worth remembering that he’s not the only bad guy in crypto. Earlier this week, the Federal Bureau of Investigation (FBI) accused North Korea of being behind one of last year’s biggest crypto hacks, where roughly US$100 million was stolen from a company that allows users to transfer cryptocurrency between blockchains.

On Tuesday, the FBI announced that the Lazarus Group — a consortium of hackers linked to the North Korean government by an array of different cybersecurity companies and government agencies — was responsible for the US$100 million hack against Harmony’s Horizon bridge that occured in June last year.

The Chainsaw Weekly Wrap: Funding roundup

As crypto markets have picked up over the last month, let’s check out what’s happening with those writing cheques in all things Bitcoin and Web3.

- Web3 social wallet Tribes launches with US$3.3 million in funding to launch the world’s first mobile ‘co-wallet’.

- QuickNode, a development platform that helps Web3 builders create apps, has closed a US$60 million Series B funding round at an US$800 million valuation led by 10T Holdings. The capital will be used toward the company’s global expansion, hiring and building out the tech.

- Crypto recovery specialist, Asset Reality, has raised US$4.91 million in seed money to build a full service solution for crypto asset recovery.

- Injective, a Cosmos-based layer 1 blockchain for building finance apps that can access other blockchains, unveiled a US$150 million ecosystem initiative with partners including crypto investment firms Pantera Capital and Kucoin Ventures, market maker Jump Crypto and research and development hub Delphi Labs. The fund will back projects that accelerate the adoption of interoperable infrastructure and decentralised finance (DeFi).

- Ethos Wallet, which integrates DApps on the Sui blockchain, has raised US$4.2 million. The funds will be used for hiring, continued development of the wallet and developer infrastructure and to expand the product beyond traditional wallet capabilities.

- Web3 infrastructure startup Spatial Labs has raised US$10 million in a seed funding round that was led by Blockchain Capital. The capital will be used to develop new products and for growth initiatives.

- Bitcoin infrastructure firm Blockstream raised US$125 million to expand its bitcoin mining hosting services.

Through the thick of crypto winter and recent green shoots, the dollar bills continue to pile in.

The Chainsaw Weekly Wrap: Markets

As we said before, crypto markets have been enjoying some much-needed relief after more than a year of consistently downwards price action. While investors and market analysts have a host of different theories as to why Bitcoin and cryptocurrencies are enjoying a bite-sized bull run, the prevailing consensus is that better than expected inflation data and a more relaxed Federal Reserve have been driving cash money back into risk-on assets like cryptocurrencies.

At the time of writing Bitcoin (BTC) is approaching a new 5-month high and is changing hands for US$22,889 — up a healthy 9% for the week.

Ethereum (ETH), which tends to outperform Bitcoin when the broader crypto market rallies has seen its price even out over the course of the week. At the time of writing Ethereum (ETH) is trading at US$1,574 and is up just 1.8% from this time last week.

The Chainsaw Weekly Wrap: Winners and losers

Leading the markets into the green this week is the once-hated blockchain network Aptos (APT), which is currently up an astonishing 130% over the course of the last seven days. When the new blockchain — which is marketed as a competitor to Ethereum — was launched, it was met with resounding criticism from the crypto community, who tore it to shreds for its lack of decentralisation and concerning ownership by a number of insiders (including the now-defunct Alameda Research) who had early access to purchase large sums of the token.

Following Aptos into second place of top gainers was the native token of the smart-contract platform Fantom (FTM). The FTM token rallied a very respectable 56% over the course of this week.

Once again, there were very few losers to write about in this week’s roundup.

The biggest loser was the native token of a little-known Proof-of-Stake blockchain network called Casper (CSPR) which fell roughly 4.9%.

In second place on the loser list was token of the Helium Network (HNT) which dropped just 4.6%.

And that’s it for this edition of The Chainsaw Weekly Wrap.

As always here’s some memes.