The Reserve Bank of Australia (RBA) has confirmed market expectations of a 0.25% rate rise, bringing the cash rate to 3.35%. As Australians continue to feel the pinch of persistent inflation, the RBA has once again reiterated its commitment towards bringing it down to its target of 2-3%.

In the announcement, RBA governor Phillip Lowe noted that global inflation remained “very high” but that it was moderating due to “lower energy prices, the resolution of supply-chain problems and the tightening of monetary policy”.

Lowe cautioned that it would be some time before inflation got back to the target rates, highlighting that the December quarter’s CPI remained at its highest since 1990 at 7.8%. He suggested that inflation would decline during the year due to global and domestic demand factors, but that inflation would probably only reduce to 3% by 2025.

In the end, he stressed the ills of inflation, saying that at high levels, “it makes life difficult for people and damages the functioning of the economy”. At the same time, the RBA recognised the need to ensure the economy ticked along, recognising that the path towards a so-called ‘soft landing’ would be a narrow one.

RBA

The RBA concluded on a sombre note, saying that it expected further increases in the months ahead and that it would “remain resolute in its determination to return inflation to target and will do what is necessary to achieve that”.

All in all, the RBA provided a clear message to the market that it would do what is necessary to bring inflation down. And while it may entail pain in the short term, it was something that it remained laser-focused on addressing.

On the back of the RBA’s latest announcement, The Chainsaw reached out to financial experts in the financial sector to get their thoughts on the RBA’s decision, the potential impact on the crypto market and what may lie ahead.

Experts offer their take on RBA decision

Savvy

Bill Tsouvalas, financial services firm Savvy’s CEO, commented on the broader market saying:

“The RBA rate rise is likely to increase term deposit rates and yields across more traditional financial investment options, so this has a potential to move investments out of the crypto market which has higher unpredictability”.

Adding further, Tsouvalas felt that another three to four rate rises were on the horizon, and that while they could quash inflation, supply chain factors would remain relevant.

On the topic of whether the RBA may ultimately cave to political or industry pressure, he said that it would be determined by whether the rate rises in fact quash inflation.

Independent Reserve

Speaking with The Chainsaw, John Toro, head of trading at crypto exchange Independent Reserve, said that the RBA’s decision would impact USD/AUD exchange pairs and similarly, this “will affect cryptocurrency/AUD pairs”.

Looking forward, he added that there remained a risk of continued rate rises beyond current projections “if inflation fails to abate”. Toro noted that it was “both monetary policy and fiscal policy [that were] generally required to break the back of inflation”.

Toro added that, “the ‘goldilocks’ scenario would be a natural reduction in core inflation back to the target band, while wage inflation remains elevated above the target band. This would attribute positive productivity to the labour market and be greatly beneficial to household wealth”.

On the issue of whether the RBA may ultimately succumb to pressure to halt rate rises, he expressed doubt, saying “The RBA are independent and will act on their mandate irrespective of political pressure and industry lobbying.”

Finder

What does the rate rise do for crypto prices? Richard Whitten, a home loans expert at Finder, noted that there “doesn’t seem to be a really direct correlation between cash rate rises in Australia and crypto prices in the same way that US rate increases from the Fed can send bitcoin falling”.

However, he did note that in general:

“Higher interest rates are not good news for speculative assets like cryptocurrencies. Most of the boom in crypto prices has come in a time of low interest rates, but with interest rates rising there are better returns on safer, traditional financial products like term deposits, high interest savings accounts and (for institutional investors) bonds”.

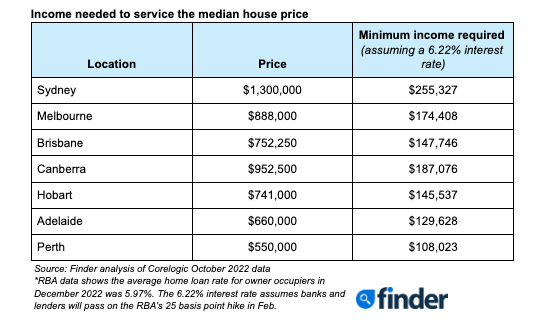

Rather than spending their income on crypto, he said that “Australian borrowers are [now] spending more of their income servicing debts like home loans”.

Like other experts The Chainsaw spoke with, Whitten felt that the RBA would probably continue to raise rates as long as inflation remains high, however, “what happens next will depend on the CPI data released monthly by the ABS”.

“Most experts and economists in the monthly RBA Cash Rate Survey predict the cash rate to peak somewhere around 3.75%, which would mean at least another rate rise or two this year”, Whitten said.

Quelling fears of non-stop rate rises, he issued a caveat saying he didn’t think “we’ll see anywhere near the speed and frequency of rate rises in 2023 that we saw in 2022.”

“It seems paradoxical to reduce inflation (and therefore cost of living) by making home loan repayments more expensive, but it does work”. Noting that rising house costs were a driver of inflation, he added that there were other forces in play such as “supply chain issues relating to the pandemic, China’s recent lockdowns, Russia’s invasion of Ukraine and rising rates around the world”.

Cumulatively, he argued, these factors would arguably place a ceiling on the extent to which the RBA could raise rates to quell inflation. That said, he stressed the tightrope the RBA is currently walking as they are “under serious pressure to keep inflation down without jacking rates up so high it ruins the economy.”

The impact of the RBA rate rise

As several experts noted in discussion with The Chainsaw, there isn’t necessarily a direct impact on cryptocurrency markets, but at the very least, it does draw a certain amount of capital away from more speculative investments towards savings.

Exactly how that manifests itself in the short term remains to be seen.

Of those most adversely impacted by the RBA decision, home owners undoubtedly take the cake. Many Aussies homeowners are increasingly finding themselves under pressure as over 50% of ultra low fixed rate mortgages are set to expire in 2023, resulting in an increase in monthly payments by 40%, to as much as 60%.

Based on the RBA’s latest decision and commitment to continue to raise rates, homeowners appear to be on the receiving end of even more pain going forward.