RBA pilot: Two of Australia’s largest banks, Commonwealth Bank (CBA) and ANZ, have joined the Reserve Bank of Australia’s (RBA) pilot program to explore use cases and assess the benefits of an Australian digital dollar, also known as a central bank digital currency (CBDC).

CBA and ANZ will work alongside 12 other financial institutions, including smaller fintech and payments companies to begin testing Australia’s first real digital dollar dubbed the ‘eAUD’. In short, the eAUD is a digital version of the Australian dollar, with the RBA saying the currency being tested in the program will be a “real-claim” on the central bank.

What is a CBDC?

A CBDC, or digital dollar, is a blockchain-based digital form of currency issued and regulated by a central bank. They are similar to cryptocurrencies but the value is fixed by the central bank and equivalent to a country’s fiat currency.

In a joint statement from the Reserve Bank of Australia and the Digital Finance Cooperative Research Centre, RBA Assistant Governor Brad Jones said the program will achieve two primary goals.

“It will contribute to hands-on learning by industry, and it will add to policymakers’ understanding of how a CBDC could potentially benefit the Australian financial system and economy,” he said.

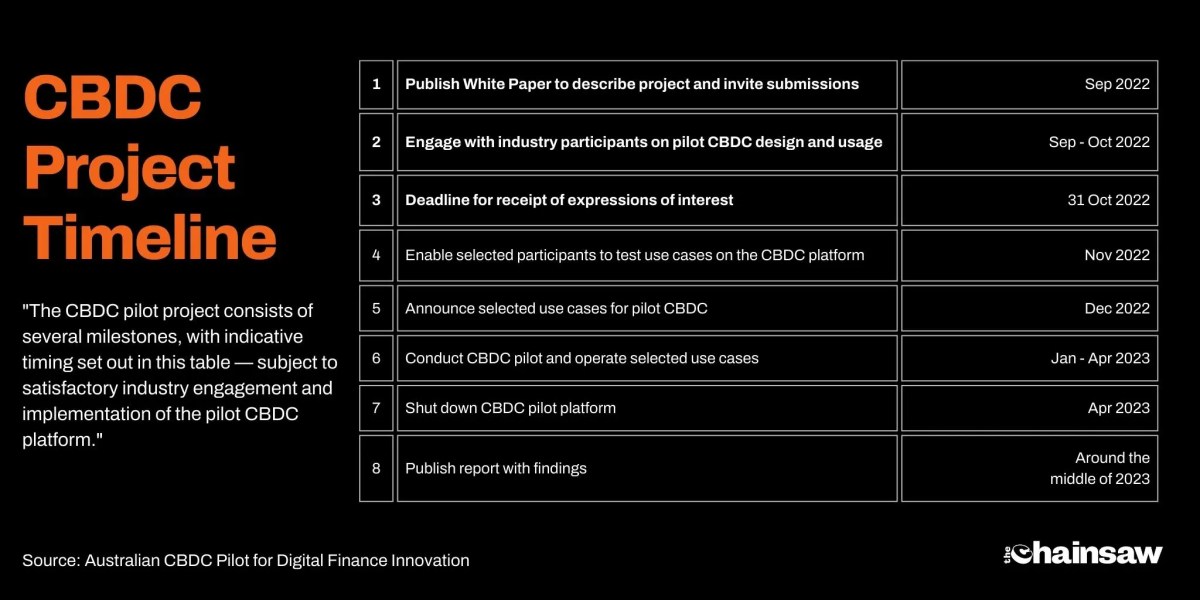

The pilot project will officially launch on March 31 and finish on May 31. A final report on the program, including an assessment on the effectiveness of the cases is scheduled to be published June 30.

The use cases being piloted include offline payments, trading digital assets, tax automation, trading foreign exchange services on blockchain-based systems and settling corporate bonds.

A notable addition on the list includes the testing an interoperable CBDC for “trusted Web3 commerce,” which will be led by international payment giant Mastercard and Australian-based banking firm Cuscal.

RBA pilot

Today’s announcement marks the sixth stage of the RBA’s overall research plan for digital currencies and officially places Australia among the first movers in the global economy when it comes to CBDCs.

A growing number of central banks from around the world, including countries such as the UK, Canada, Brazil and Mexico are all in the process of exploring how government-issued digital cash can be used for trade in the emerging blockchain-based economy.

Mark Monfort, the Director of Australian Web3 Venture Studio Not Centralised told The Chainsaw that being selected as part of the pilot program was a major step forward for figuring out how blockchain technology can improve archaic segments of the Australian economy.

“We’re proud to be part of the pioneering group that will evolve how financial system could work and the potential this has to deliver more economic opportunities for Australians,” Monfort said.

“Our project use case involves the improvement of opaque construction supply chain workflows via the use of escrows and controllable payments. We are working on this with real clients and are excited to see this come to life.”

Mark Monfort.

RBA pilot: Australia paves the way for digital dollars

Commonwealth Bank’s Managing Director of Blockchain and Digital Assets, Sophie Gilder said today that there are two primary areas that the bank is looking forward to experimenting with.

“Two areas where we see the most potential are real asset tokenisation and smart payments, and we have chosen to explore use cases in those domains. Our focus on sustainability, productivity and emerging technologies aligns to the goals of the RBA and other industry participants,” Gilder said.

“While it will take some time to assess the exact roles that blockchain and specifically a CBDC will play in the future of the financial system, it is essential that Australia continues to build our capabilities in this key area of finance and explore the possibilities of emerging technologies,” Gilder added.

In May last year, ANZ became the first Australian bank to launch a AUD-based digital stablecoin, dubbed the ‘A$DC’.

The National Australia Bank (NAB) is the most recent bank to join the blockchain frenzy, introduced its own ‘AUDN’ stablecoin on January 19 this year. The AUDN stablecoin is built on the Ethereum network.