FinTok: Gen Z are the most ‘digitally native’ generation ever to have existed, which is having a significant impact on the way that Zoomers interact with the already bewildering world of finance.

The average Zoomer spends an average of eight hours a day looking at a screen. And while the majority (52%) of us — I’m including myself here as an honorary late-stage Zoomer because I was born at the tail end of 1996 — seem to think that our online personas reflect us more than their real ones do, this huge amount of time spent on the internet is having some interesting effects on how we manage our cash moneys.

Worryingly, Zoomers have an average attention span of just eight seconds, and this somewhat troubling statistic is ever-present in how we choose to engage with social media, with the most popular platforms for our generation being, in order: Snapchat, TikTok, and Instagram.

FinTok

This monumental amount of digital immersion seeps into the world of finance in a big way, with the bulk of our generation allocating more of our investment portfolios towards crypto, 97% of us opt for mobile banking apps, and most prefer to access all customer services online.

Here’s all the latest insights on how young people are handling their money business.

3 in 4 Zoomers get money education from digital media

According to a new report from MoneyLion which surveyed 4,400 people between the age of 18 and 40 from the United States, a whopping 75% of young people get their financial information from digital media, which is dominated by social media platforms.

While this may provide some benefits in terms of staying up to date with the immediate day-to-day movements in the market, the overall financial literally of Gen Z has fallen well below that of other generations.

Gen Z turn to TikTok for financial guidance

So which platform are Zoomers getting the bulk of their monetary education from? It’s none other than TikTok, with the new subsection of finance being dubbed ‘FinTok’ — a smushing together of the words ‘finance + TikTok’.

Now, despite there being a roaring industry of FinTok influencers, who unanimously claim to condense complex financial information into ‘actionable’ bite-sized clips, the survey found that most young people remained ignorant of many basic financial concepts.

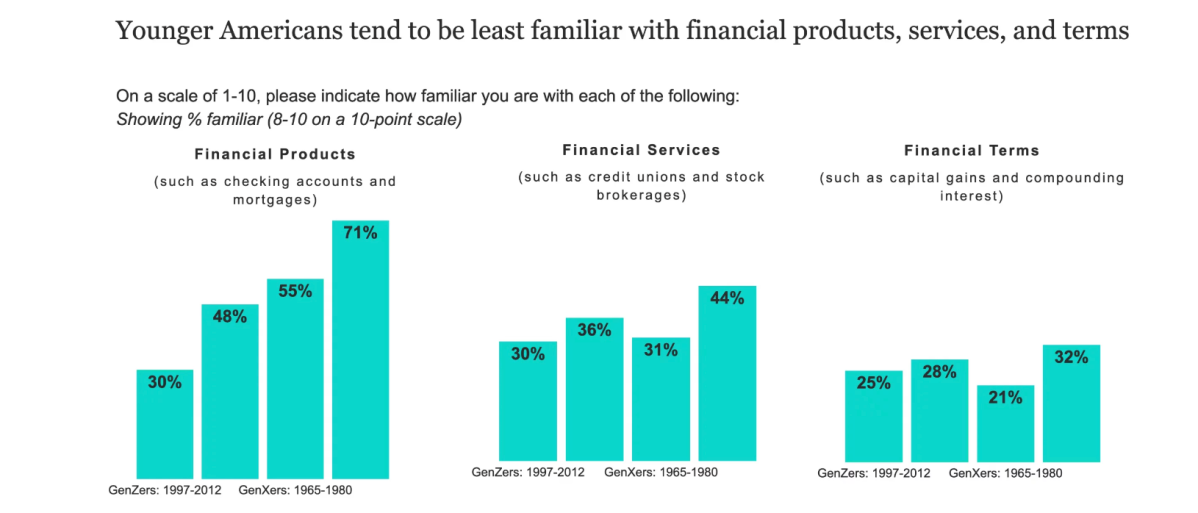

A mere 30% of Gen Zers and 48% of Millennials were familiar with financial products like checking accounts and mortgages. Just 30% of Gen Zers and 36% of Millennials could name the difference between a credit unions and stock broker, and only one quarter of Gen Zers and 28% of Millennials were up to speed with financial terminology like ‘capital gains’ and ‘compound interest’.

It’s no secret that platforms like TikTok are overflowing with questionable content and downright misinformation, however despite the meteoric rise of people that claim to be “financial educators”, the need for legitimate, well-rounded content on the core concepts of finance is dire.

“Our survey shows that there is a real need for financial education that is delivered via digital channels and in the format that people consume media, particularly among younger generations,” said Cynthia Kleinbaum, Chief Customer Officer at MoneyLion in a statement.

Crypto and digital finance is the playground of Gen Z

Another interesting find was that Zoomers have essentially been forced into become investors far sooner than any other generation. The report lays the blame for this accelerated interest in all things investing at the feet of increased anxiety around the cost of living, as global inflation continues to surge in the wake of the global pandemic.

Additionally, the survey found that the way we Zoomers access financial services differs greatly from older generations. We (understandably) have a high level of distrust for traditional financial providers, and place greater faith in online platforms and digital alternatives to brick and morter outlets.

We are far more likely to attain services from a neobank or a digital lender, and find it much easier than heading down to the local bank branch. Even when things get difficult and we need to speak to someone to solve a problem, most of us (roughly 60%) would rather speak to a chatbot than be forced to go into a physical branch and speak with a human from the bank.

We’re also far more likely to invest in cryptocurrency than any other generation. While stocks remain the most common investment, with 60% of Zoomers owning them, a staggering 54% of us own cryptocurrency, at least according to research by the online investment platform Saxo.