Wash trading in the decentralised finance (DeFi) space is rampant. A report by crypto integrity firm Solidus Labs states that since September 2020, wash trading has manipulated the prices of over US$2 billion (AU$3.11 billion) in crypto.

… and this number is only for Ethereum-based decentralised exchanges (DEXs).

What is wash trading?

In the crypto space, wash trading is a type of market manipulation. According to Solidus Labs, it’s when “one entity simultaneously buys and sells the same asset, creating a false impression of market activity despite the trade reflecting no change in beneficial ownership”.

The purpose of wash trading is to artificially inflate the price of a crypto asset, giving outsiders the illusion that there are genuine active trades happening, to attract interest in said asset.

Solidus Labs’ report shows that since September 2020, the prices and volumes of over 20,000 tokens have been manipulated. More than two thirds (67%) of almost 30,000 crypto liquidity pools across sampled DEXs have seen wash trades executed.

Mind you – the DEX liquidity pools sampled in the report represent just 1% of all liquidity pools in the crypto space. And there are probably thousands of liquidity pools in the industry.

Who does it, and why?

According to Solidus Labs:

- Exchange and marketplace operators: To report higher trading volumes to investors

- Crypto market makers: To anchor a crypto token’s market price above what they may have negotiated with a token’s issuer

- Individual speculators: To top crypto and NFT leaderboards

- Token deployers: To mislead traders into investing in a crypto project

In other words, it’s pretty common across the crypto space.

Types of wash trading

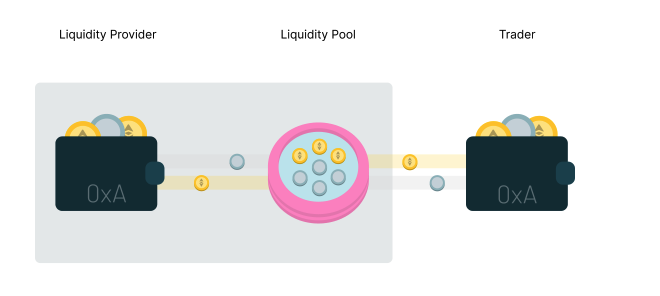

The Solidus Labs report circles two main methods of wash trading in crypto. The first is known as A-A wash trading – this is when a single crypto wallet plays the role of both buyer and seller to manipulate the price of a crypto token.

For example, a wash trader wants to exchange Ethereum (ETH) for an unknown crypto project – let’s call it PeePeeCoin – to drive up the price of the latter. So, they contribute a hefty sum of ETH to a platform’s liquidity pool, and swap the ETH for a chunky sum of PeePeeCoin.

When A-A wash trading occurs, “no change in beneficial ownership takes place” because the person orchestrating those trades is the same person – kind of like that popular Spider-Man meme. Yet, each swap changes a crypto token’s price. So, wash trading gives a false market signal to investors, with the goal to trick them into believing that a crypto asset has market interest.

Solidus Labs’ report has identified US$960 million (AU$1.49 billion) worth of A-A wash trades since September 2020.

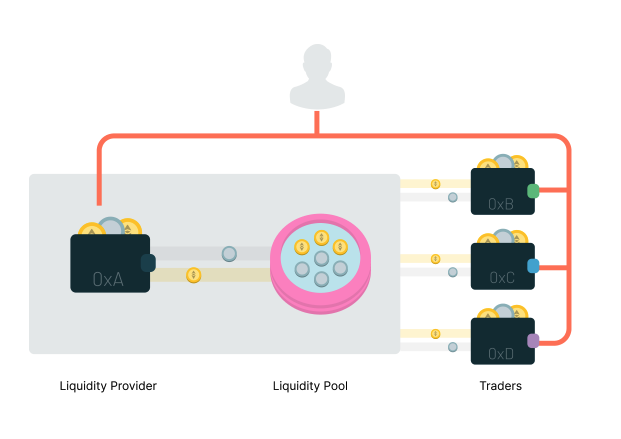

The second type of wash trading is known as multi-party wash trading. It’s when different crypto wallets are involved, but they’re controlled by the same entity. Again, it’s like that popular Spider-Man meme, except there are three (or more) Spider-Mans this time.

Since September 2020, there have been US$1.1 billion (AU$1.71 billion) worth of multi-party wash trades.

Is wash trading legal in Australia?

No. The ATO warns Australians not to engage in wash trading as it is a form of tax avoidance. How so? The ATO’s official website explains:

Wash sales typically involve the disposal of assets such as crypto and shares just before the end of the financial year, where after a short period of time, the taxpayer reacquires the same or substantially similar assets. This is a wash sale and is done to create a loss to offset against a gain already derived, or expected to be derived, in certain circumstances, in a tax return.

Those who do are at risk of “swift compliance action”, “additional tax”, and in some cases, interest and penalties may apply. Tax advisors who promote wash trading may also face legal action from the ATO.

“Don’t hang yourself out to dry by engaging in a wash sale. We want you to count your losses, not have them removed by the ATO,” explains Tim Loh, Assistant Commissioner at the ATO.

So, better be safe than sorry.