Crypto whales are worth watching. Here’s why. Let’s start from the beginning. What on earth is a ‘crypto whale’?

Crypto whales are individuals or institutions that hold a large amount of cryptocurrency. What qualifies as a whale can be quite loose in terms of how it is defined, but generally speaking, to be a Bitcoin whale, you need to hold around 1000 BTC (currently US$172,138 million).

For other coins, like Dogecoin (DOGE) and Shiba Inu (SHIB), you’ll need more than 1000 tokens, as they are not as valuable as Bitcoin. But whatever the crypto, all whales can impact the price of coins depending on what they do with their tokens.

Whales and their influence

An example of how whales can affect prices can be seen in a big splash that an Ethereum (ETH) whale made last year. The price of the cryptocurrency dropped from US$1600 to just US$700. This happened on the Kraken exchange with its CEO saying at the time that the price fall was probably due to a whale selling all of their ETH at once.

It’s moves like that which causes many investors to become whale watchers of the crypto kind. While whales can move their crypto assets around a lot, we can only use the information to guess their next move – nothing is guaranteed. However, this hasn’t stopped investors from watching whales and trying to preempt their plans.

And it’s not only individuals who are at it. Institutional investors, like Blackrock have been moving into crypto assets. These institutions are also considered to be whales and will no doubt have more power to affect crypto markets in the future as crypto becomes increasingly mainstream.

Whales and volatility

Whales have vast supplies of coins, so their movements can increase market volatility. And traders just love volatility, on the way up and down. To illustrate, here’s a possible example of how whales could use volatility to their advantage.

A single whale, or several whales who know each other and who communicate with each other, could cause a price crash by moving their crypto out of their cold wallets and onto an exchange. How? The market sometimes interprets this move alone as an indication of the whales’ plan to sell their crypto. Other holders could see this move and sell, driving the price down even further. Meanwhile, the original whales could then dive in and buy the lower-priced coins. This is without the whales having sold anything at all!

After the price falls, more retail investors could buy in, pumping the price higher. And this makes the whales even richer!

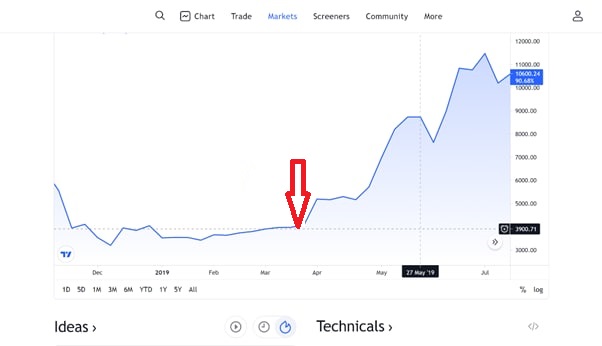

A historical example can be seen on April 2, 2019. In just two hours, Bitcoin jumped in value from US$4,200 to nearly US$5,000. Many traders got excited at the new breakout.

However, the cause was a single buy order of a whopping 20,000 Bitcoin. That one whale changed the sentiment in the crypto community, proving how whales can move markets. By June, the price had appreciated by 240%.

Blockchain-based transactions make it possible to monitor whales before they make their move. This means that retail investors can get their ducks in a row before the whales make their final moves known.

Generally speaking, if whales are selling their crypto assets while the markets are rising, this could indicate that the whale thinks the market could be near the top. That might not be true, but a whale selling at this point could actually turn market sentiment anyway.

How to whale watch: wallet to exchange

Wallet-to-exchange transactions can be followed. This is because whales usually move coins to exchanges to sell them or swap them for other coins.

A big Bitcoin move onto an exchange can mean that the whale is thinking about selling the coins. But, if they move stablecoins onto the exchange, this may be because the whale wants to buy more Bitcoin or other cryptos that they think might rise in price.

Exchange-to-wallet

Whales will almost always use a cold wallet to store coins long-term. This is because they can’t easily get hacked like an exchange wallet could. So if a whale takes coins off an exchange and puts them in a cold wallet, it usually means they want to hold onto the token for a while. Retail investors could mimic this move if they are in a position to hold onto their coins long term.

These outflows can mean that overall supply of those coins are reduced, so it can drive up the price due to scarcity.

An outflow of stablecoins, on the other hand, might not be a good thing. It usually means that the whale thinks that there isn’t anything worth investing in.

While we can watch whale movements, we can only guess what they will do next. Nothing is guaranteed. Whales know their movements are being watched by other investors, so sometimes they can move their crypto around wallets and exchanges, simply to change the market sentiment to increase or decrease prices. They then buy or sell using other wallets that aren’t being tracked. Things are not as straightforward as they may appear.

Whale tracking tools

You can track Ethereum whales by checking Etherscan. Wallets are stuffed full of ETH.

The biggest whales in this image are mostly exchanges, and have a name tag that can identify them. Today’s list, for example, contains the usual suspects like Binance, Kraken, Bitfinex and Gemini.

It’s the addresses without a name where whales are likely to reside. You can click on the individual wallets and see when the tokens were moved around. Snooping here can be a lot of fun.

If you find a wallet you want to watch, use can also use a feature on Etherscan called ‘watchlist.’

Whale Alert

An easier way to watch whales is to let others do it for you. There are a few whale alert Twitter accounts which are good to follow and do the heavy lifting for you.

But be aware, you aren’t alone… 2.2 million people follow this account (some could be bots, phew!).

Paid services

Free services are really good for getting information on whales. But you can also pay for a higher level of service though. Glassnode and CryptoQuant are examples of these services, and there are others too.

Bottomline to remember though, no platform has the full picture, you have to do your own research.