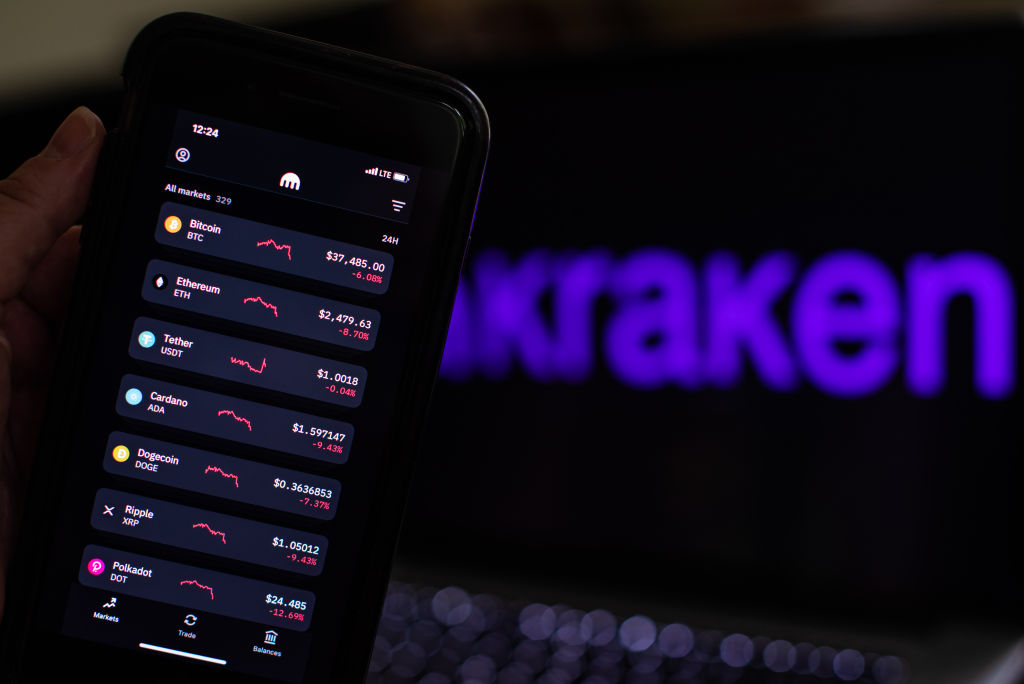

Last Friday, the US Securities and Exchange Commission (SEC) ordered crypto exchange Kraken to pay a US$30 million fine to settle a claim that Kraken had broken some the regulator’s rules. The SEC declared that Kraken had broken its rules by offering investors access to a service that allowed investors to earn yield by ‘staking’ their crypto holdings.

The main crux of the settlement is that the SEC considers Kraken’s staking services to be something that looks, smells and feels a lot like a ‘security’. If Kraken’s staking services are to be designated as such, it would impose a host of new regulatory requirements that many crypto players are simply unprepared for.

The SEC’s settlement with Kraken also confirmed broader fears — which first were introduced by Brian Armstrong on Wednesday last week — amongst crypto market participants that the agency may start looking to more heavily regulate the practice of crypto staking altogether.

The difference between ‘staking as a service’ and ‘staking’

When we take a proper look at what the SEC wants to regulate, there are two main types of staking in question. It’s a tiny bit technical but, but bear with me and I’ll explain the significant and important differences between the two types of staking.

The first is the type of staking is offered by big crypto exchanges like Kraken who provide crypto investors with interest on their deposits in exchange for locking up tokens on their platforms. This is called ‘staking as a service‘ and is distinct from the practice of ‘staking’ in a broader sense.

The other type of staking is a broader, catch-all term that refers to the act of staking one’s tokens to secure and maintain a blockchain network. In this wider framework, the practice of staking is when ‘stakers’ lock up their tokes directly onto a blockchain, a process which often uses multiple computers and requires familiarity with a lot of complex software and information.

This one of the key differences to note. Instead of using a centralised exchange — like Kraken — to earn a yield on deposits, crypto ‘stakers’ interact with a blockchain network directly and lock up their tokens their tokens in this manner.

Typically, stakers interacting directly with a blockchain network will be depositing vast sums of crypto on these networks, and in doing so form the unofficial backbone of the modern crypto industry (but more on that in a second).

While the SEC hasn’t come out and stated anything outright, rumours that they may eventually move to ban the practice of crypto staking in its entirety has ruffled feathers in the industry. Such a move would majorly disrupt all the day-to-day operations for blockchains that run on a Proof of Stake consensus mechanism.

In case you’re reading along and thinking “wtf is a Proof of Stake consensus mechanism?” — don’t worry, we’ve got you covered.

Proof of Stake explained

A blockchain that uses ‘stakers’ to secure its network uses what’s called a Proof-of-Stake consensus mechanism. A number of major blockchains including Ethereum (ETH), Solana (SOL) and Cardano (ADA) all use this process to maintain security and decentralisation on their networks.

So why do these blockchains use Proof of Stake? And what are the alternatives?

Proof of Stake vs Proof of Work

Well, the biggest benefit of using Proof of Stake is that its faster, cheaper and more energy efficient than the other only real alternative, which is called Proof of Work.

The world’s largest cryptocurrency, Bitcoin (BTC) runs on a Proof of Work mechanism. Instead of using ‘stakers’ to maintain its network, Bitcoin users ‘miners’ (hence the term “Bitcoin mining“). These miners conduct the digital equivalent of labour, by solving extremely complex cryptographic puzzles to secure the its network.

While advocates for Proof of Work blockchains argue that they are more secure and decentralised than any of the alternatives, it has one major downside: it uses astonishing amounts of power.

To put the benefits of Proof of Stake in perspective, when Ethereum recently transitioned from the power-guzzling Proof of Work, it reduced its overall energy consumption by a staggering 99.95%.

Why does the SEC have a problem with staking?

So, Proof of Stake is so wonderful (environmentally at least), then why does the SEC have such a big problem with it?

As we’ve just learned above, Kraken along with many of other centralised exchanges including Binance and Crypto.com have been offering ‘staking as a service’ products. The SEC doesn’t like this because it considers it to be something that looks a lot like crypto lending, which they clamped down on hard in the wake of a rolling wave of bankruptcies from lenders like Celsius and BlockFi.

Because both crypto lending and ‘staking as a service’ products pay investors a yield, the SEC views them as securities.

What happens if the SEC decides that staking is a security?

So, let’s assume the worst case scenario and say that the SEC does deem all crypto staking products to be a security. For starters, this would only impact stakers in the United States, and Proof of Stake blockchains are usually secured by users from all corners of the globe. It’s unclear how much impact it would have on the industry more broadly, but it would set a precedent that other governments may look to follow.

For the time being, if the SEC chooses simply to deem ‘staking as a service’ products as securities, it will introduce US-based crypto exchanges to a whole host of investor-protection and disclosure requirements.

Any US exchange that chooses to continue offering staking products in light of this would face more heat from the authorities, which could result in fines and potential criminal prosecutions if the agencies like the Department of Justice decide to throw their hat in the ring.

The most notable downside would be the lack of funding from venture capital firms, who will undoubtedly be scared of treading on regulatory toes.

Still, there are some supporters of the SEC’s regulation, who believe that treating staking as security would lead to greater protection for investors and increase wider crypto adoption in the long-run.

Mark Monfort, the Director of Australian Web3 Venture Studio Not Centralised told The Chainsaw that the SEC coming down staking in the US may not spell disaster in an immediate sense, there’s still plenty of valid for crypto market participants to be concerned.

“Rumours are often worse than reality but its right to be worried for those in crypto with the crackdown on Kraken. If staking is banned it significantly impacts Proof of Stake blockchains like Ethereum that rely on this for their consensus mechanism versus the more environmentally unfriendly Proof of Work.

It also reduces incentives for folks to participate in networks and thereby further reduces security and overall decentralisation.”

While Monfort says it’s still to early to get overly worried about a major crackdown on staking, the SEC’s move sets a worrying precedent.

“Even though the SEC’s ruling on Kraken was just related to US retail consumers, it’s easy to see how other governments may follow suit. The reasons for this, if its just pointing to the potential fraud aspects, don’t really stand up. We’ll be watching this space closely.”