Australian investors seeking exposure to the developing metaverse market can now access a plug-and-play portfolio curated by trading platform eToro, combining stocks in tech giants Meta and Intel with crypto assets like Enjin and Mana.

eToro announced the launch of its MetaverseLife portfolio on Friday, billing it as a one stop shop for local investors and speculators prepared to drop real-world money on the promise of new digital growth.

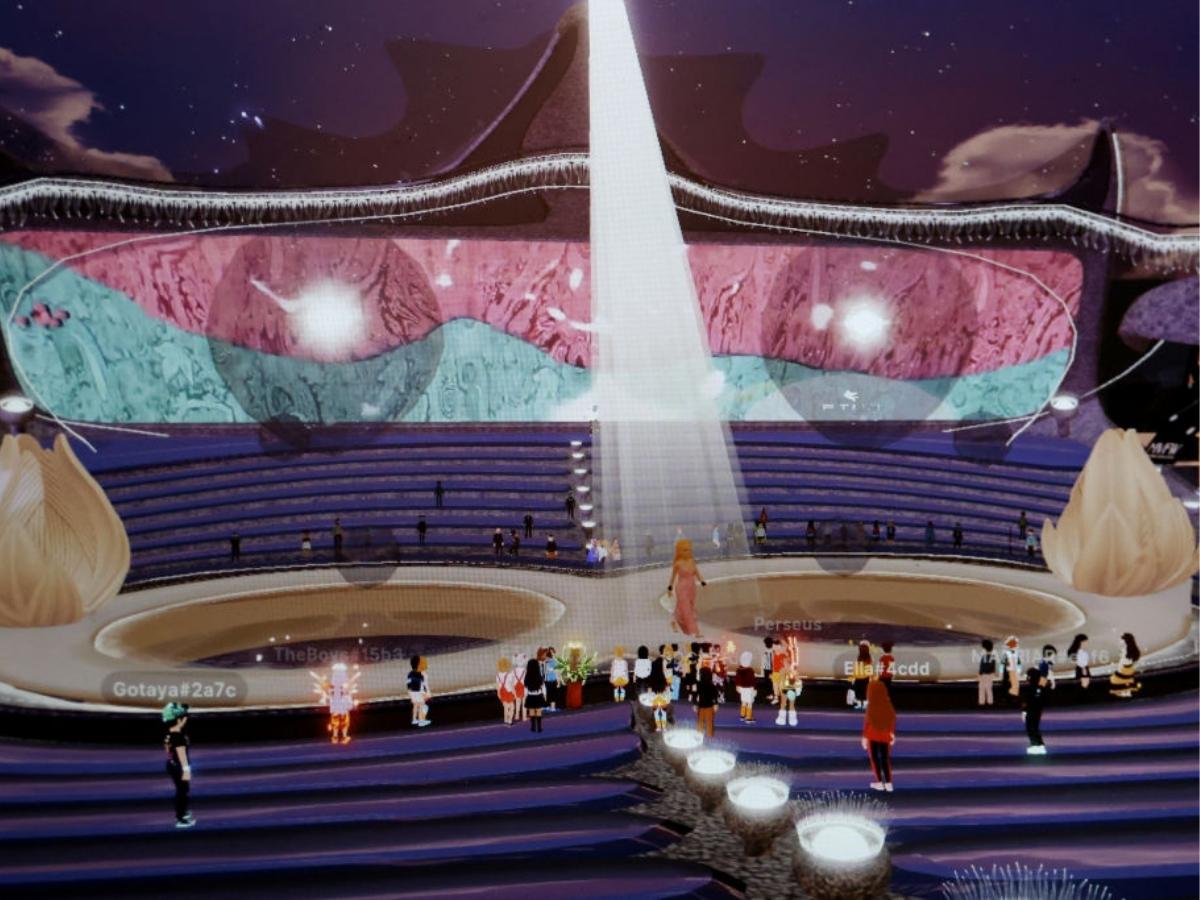

The metaverse describes an immersive virtual world allowing users to interact, work and spend in ways beyond the limitations of present-day internet infrastructure.

Analysts estimate the metaverse economy could grow to trillions of dollars in value. Facebook has also bet big on its potential, changing its name to Meta last year as proof. Local players, including Tennis Australia, are now launching virtual properties in projects like Decentraland.

But despite the billions of dollars of investment pouring into the space, the metaverse is still largely conceptual. Current expressions of the nascent digital realm, including Meta’s, are yet to match the full utopian vision held by true believers.

Metaverse portfolio

eToro bills its MetaverseLife portfolio as a way to gain exposure to dozens of assets without dumping capital on any one security or coin, which may wane in value as the metaverse matures.

“Not everyone involved will be a winner,” Dani Brinker, eToro’s head of investment portfolios, said in a statement. The new offering is a way for users to do without the “heavy lifting” of meticulous research, Brinker added.

Australian investors could already compile any of the 28 assets currently included in the MetaverseLife portfolio themselves — and many already have. Meta, nee Facebook, became the sixth-most held security by local eToro users in the final months of 2021, rising seven places over the December quarter.

However, the MetaverseLife portfolio goes where traditional share portfolios do not, combining those shares with exposure to Decentraland’s Mana coin, The Sandbox’s Sand coin, and Enjin Coin, linked to Enjin’s gaming-focused web ecosystem.

Exposure to those coins comes with its own set of quirks — most prominently, the fact that Australia’s financial regulators are yet to catch up with crypto asset trading, leaving investors without the protections they might expect from a simpler securities portfolio.

Crypto-focused ETFs are on the rise in Australia, but are yet to fully integrate cryptocurrencies and blockchain assets themselves. Suggested portfolios like eToro’s may bridge the gap, before clearer regulation comes into place.