As the crypto market continues to stare down bearish sentiment, the Bitcoin mining industry seems to be in a spot of trouble.

According to recent data obtained from crypto analytics firm CryptoQuant, miners have been bailing on their Bitcoin (BTC) holdings in an unprecedented fashion, with miners setting a new record or the highest amount of Bitcoin sold by miners sold in a single day — ditching a whopping $300M worth of Bitcoin earlier this year on June 15.

When Bitcoin miners begin dumping large volumes of Bitcoin onto the market, it’s what’s called “miner capitulation”, which means that miners are selling their current holdings, often at a loss, to cover ongoing costs.

Essentially, they know winter is coming so they’re battening down the hatches, stocking the shelves and preparing to be snowed in for an unknown period of time.

Bitcoin mining: Is it still profitable?

While everyday people may have felt the squeeze of the current less-than-ideal macroeconomic climate, the brutal combination of Bitcoin prices faltering at yearly lows with surging electricity costs has become too much for many Bitcoin miners to bear.

Core Scientific (CORZ), one of the largest publicly listed Bitcoin mining firms in the US, admits to selling nearly all of its Bitcoin to fund future operations. CEO Mike Levitt told CNBC that while it’s still profitable to mine Bitcoin, margins have slumped from upwards of 80% down to roughly 50% across the industry.

Levvit said the $167M proceeds of CORZ selling 7,202 Bitcoin at an average price of $23,000 were directly invested into growth-oriented activities such as updating equipment and servicing its debts.

Citibank analyst Joseph Ayoub wrote about the increased pressure on miners, in a note attached to a Citigroup Research Report earlier in July, stating, “Given rising electricity costs, and Bitcoin’s steep price decline, the cost of mining a Bitcoin may be higher than its price for some miners.”

“With high-profile reports of resignations from mining companies, as well as miners that have used their equipment as collateral to borrow money, the Bitcoin mining industry could be under growing pressure,” Ayoub continued.

Are Bitcoin miners screwed?

Despite this supply-side pressure, a lot of Bitcoin miners seem to be relatively unphased.

Nick Hansen, the CEO of Bitcoin mining firm Luxor Technologies, told The Chainsaw that he’s not too concerned by the current market conditions, “this kind of selling happened in the last bear market too. Public miners tend to hold onto their BTC when times are good and dump them when market conditions take a turn for the worse.

“I’m not worried about the selling because it seems like public miners sold what they needed to over Q2 and the selling has slowed,” Hansen said.

“Plus this is actually healthy for the network long-term because it shows that there’s no free-lunch with PoW. Unlike PoS where validators can hoard funds with no cost, miners have to carefully expand,” he added.

Bear market blues

According to Hansen, it’s “very likely that some industrial-scale miners will go bust during this bear market” but these sort of events ultimately allow for “miners elsewhere with more robust operations would purchase their assets and continue mining in their stead.”.

Painting a broad picture of the current state of Bitcoin mining, Hansen elaborated, “In the US at least, people tend to think about big public companies like Core Scientific, Riot, Marathon, and others as the face of the Bitcoin mining industry, but these public miners only represent roughly 10-15% of the global hashrate.

All of that to say, they are not representative of the mining industry as whole,” he concluded.

It’s important to note that Bitcoin mining doesn’t occur in a vacuum — as the price of Bitcoin falls and energy costs increase, the competition decreases for the production of Bitcoin, which is measured by what’s called the “hashrate”. After falling a little over 15% throughout June, the hashrate has bounced back alongside a sharp uptick in the price of Bitcoin.

Bitcoin mining: But what about the environment?

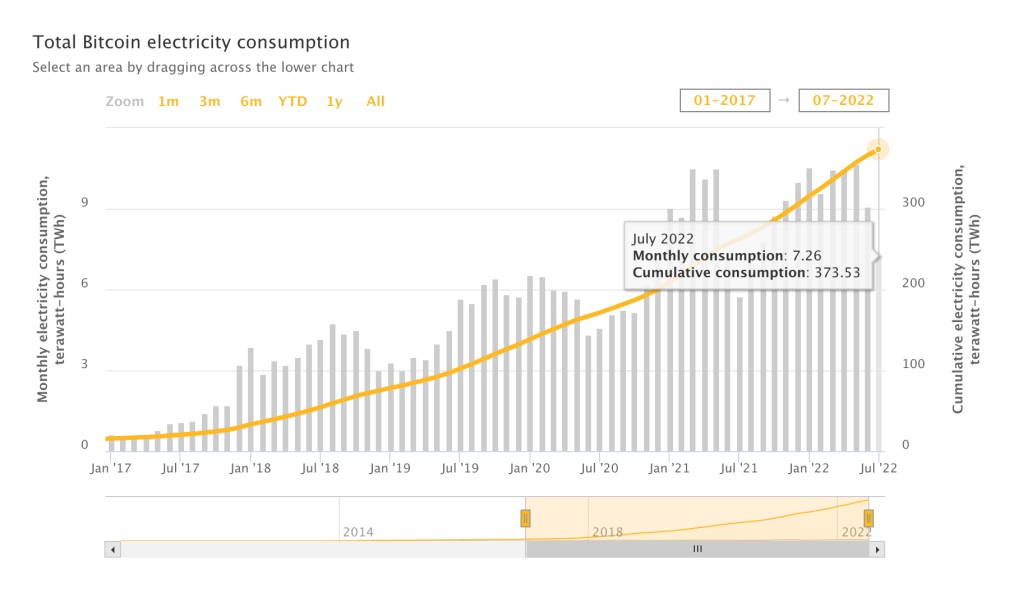

There’s no point in trying to deny that Bitcoin has a chequered history when it comes to energy consumption, however according to recent research from climate tech investor Daniel Batten, Bitcoin mining has rapidly shifted towards using higher volumes of renewable energy.

Batten found that despite the increasing amount of energy consumed, the Bitcoin network has already seen 11% of its power consumption move to renewables since China banned domestic mining operations in May 2021.

According to Batten, multiple mining operations are beginning to make pledges towards going 100% carbon neutral, with one of the largest mining operations in the world, Marathon Holdings, ending all contracts with non-renewable energy suppliers earlier this year.

Additionally, since the start of 2021, the number of major Bitcoin mining companies that actively mitigate methane emissions has increased from 1 to 12.

Overall, this evidence of better energy usage, combined with the confidence of established Bitcoin miners, show that rational actors throughout the mining industry are approaching the bear market as an opportunity to wrangle overheads and become more efficient moving forward.