There’s never a dull day in Bitcoin, that’s for sure. Last year, while everyone’s attention was on major crypto exchanges and tokens blowing up — thanks FTX and Celsius — Bitcoiners who hold their own keys have slept sound at night and humbly stacked sats thanks to a network secured by Bitcoin miners.

But spare a thought though for these struggling miners. They are the brave (or foolish) individuals and companies in every country in the world that secure the Bitcoin network with their time and their capital at risk. In exchange, they compete for an ever-dwindling chunk of the remaining unissued 1.726M BTC (the last 8.2% of the total 21M bitcoin that will ever exist). As public Bitcoin miners have scrambled to stay afloat, some home miners continue undeterred. Let’s dig into why that is the case, but first, some Bitcoin mining 101.

Bitcoin, “Proof-of-Work” and the connection to Bitcoin mining

Miners provide an unforgeable real world physical cost to producing new bitcoins – a crucial factor which is why it is but one of the reasons it is considered valuable.

Central bankers and crypto project leaders can simply decide to manifest new units of their fiat currencies out of thin air. Their cost to create new dollars, pounds or FTT is essentially zero.

By contrast, the remaining unissued fixed supply of bitcoins are released every 10 minutes or so via a competitive “Proof of Work” process done by miners – which establishes a gradually increasing cost to produce new units of the currency.

In summary, bitcoin mining secures the network and requires the unforgeable cost of electricity to produce new units, which together with its fixed supply makes it valuable.

Bitcoin miners are struggling

It all sounds rather exciting and profitable, but the reality is that miners are in pain. Big time. So why are miners of all stripes struggling?

After the dizzying profits of 2021 from the ban on mining in China, a rocketing bitcoin price and supply chain squeezes that slowed down miners’ ability to turn on more machines, 2022 going into 2023 has been a very different landscape.

Simply put, miners live or die based on the levers they can control in their business, which are:

- Finance — do I take on debt or do I dilute my equity with investors to pay for my machines and my expenses?

- Power — where do I get my power from and how do I structure my agreement to pay for that power?

- Cashflow — what do I do with the coins I generate? Hold onto them or sell as I go? Do I let others use my infrastructure and charge for hosting?

This year, miners who optimised their business for 2021 conditions have found themselves with all the wrong settings on these levers.

Those who picked financing their growth by debt versus equity, such as Core Scientific, are now caught in a high interest rate environment and equipment financing commitments where their monthly finance costs far exceed their revenues.

Many miners used high-priced mining equipment as collateral on loans. There is now an oversupply of mining equipment, and the value of this collateral has now plummeted to way below the loan amount owing. With many miners, such as a subsidiary of Iris Energy, then defaulting on these loans (financed by specialist lenders such as Bitcoin financial services company NYDIG), access to new debt from burned lenders on favourable terms is rare.

Those who didn’t lock in profit sharing-based energy price agreements are faced with a global crisis in rising power costs. Power generators can now shun the bargain hunting and ESG red-flagged bitcoin miners, instead selling their power for very high spot prices available on the grid.

In short, miners who picked the wrong strategy or focused on the wrong levers outlined above probably got nailed in 2022.

With bitcoin prices depressed from a variety of global events and a lot more competition than last year, miners now generate much lower revenues than they had forecast in their financial models. Many are losing money daily and having to sell assets or take on more high-priced debt just to pay bills and keep the lights on.

And for those that hoarded their bitcoins during the bull market hoping for further capital gains and using debt or equity to pay the bills? Miners such as BitFarms and Core Scientific were forced to liquidate their coins and even some of their mining equipment at fire sale prices. Ouch.

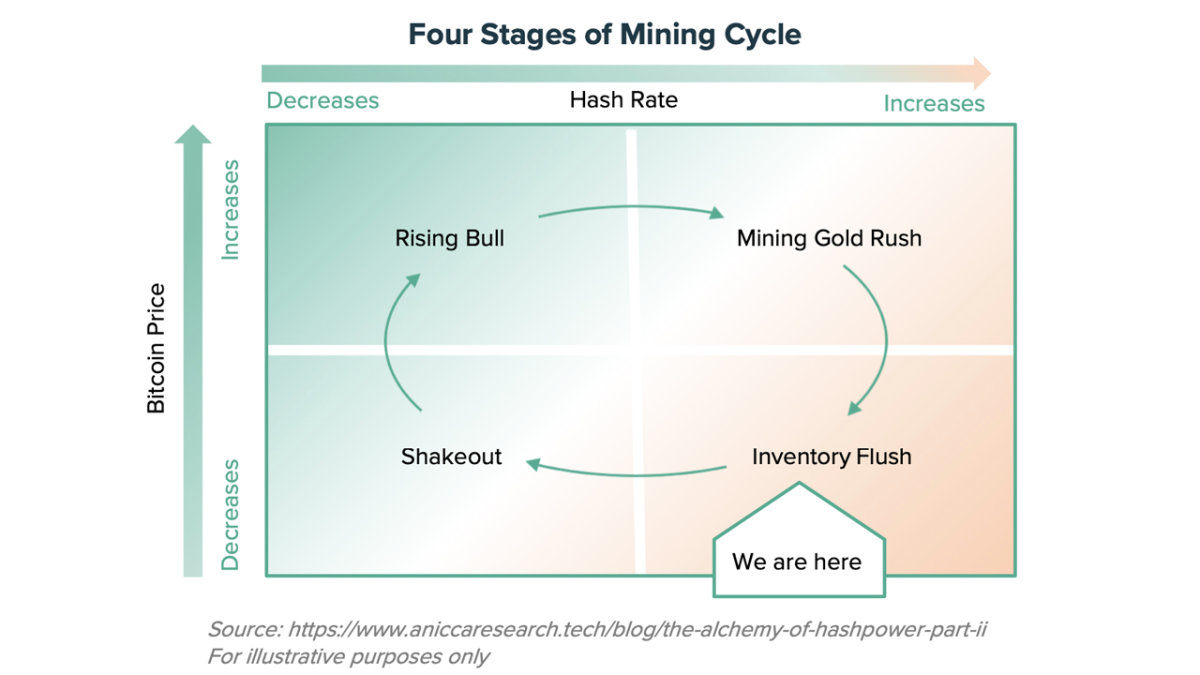

Bitcoin price is down but hashrate is near record levels?

As hinted earlier, its not just the increased cost of energy and depressed bitcoin prices hurting miners, its the scope of competition reflected in the hashrate.

Why, in this challenging environment, does hashrate (a measure of the number and scale of miners competing in the industry) keep on rising to new all-time highs whilst the rewards available to miners continue to plummet and even go negative?

One possible reason is that in the public mining space, many expansions committed to in 2021 are only now getting delivered and switched on. Another reason is that new entrants and incumbent survivors are able to capitalise on the combination of cheap machines flooding the market, as well as many abandoned hosting projects that can be snapped up in the US for a fraction of their 2021 valuations. These projects, on paper at least, are now profitable based on today’s economics, but they’re not for the timid.

In late 2022, for only the third time in bitcoin mining history, the average cost of producing bitcoin exceeded the market value of the bitcoin being produced.

This accelerated the drive towards several high-profile bankruptcies and industry consolidation – with the stronger miners acquiring the operations and assets of the weaker miners.

So, if these massive well-funded and expertly led public companies, with all of their enormous efficiencies of scale, have got themselves into such a mess, what chance do simple pleb home miners have to keep their machines running? And does this threaten the network’s security?

Home mining has benefits but its not for everyone

Not so fast. Home miners are a dedicated bunch – many of them will happily leave their machines running even if they are technically mining at a financial loss. Why? A home miner has usually already paid for their equipment – so it’s a sunk cost.

Many are funding their ongoing mining expenses – mainly their power bill – from other sources of income or they are able to claim deductions against a business. Others use their mines at home as a source of heating (as seen in Canada) or a conversation point for their friends.

The majority also see an additional advantage to mining at home – complete privacy of the bitcoin their machines produce. There is no permission needed to start mining, no central authority to contact nor is any license approval required. There’s absolutely nowhere where you need to enter your name or follow a KYC process like you would on an exchange. Mined coins just drop into your bitcoin wallet completely anonymously.

Ultimately, many Bitcoiners are driven by this right to freedom, control and privacy over their holdings and it’s the mines operated by these plebs that will always be whirring, irrespective of what is happening with the bigger players and bitcoin price.

While some may find bitcoin home mining enormously complex and difficult to understand, there are opportunities to outsource that legwork to the professionals.