Bitcoin halving: It is now just 9 months until this huge event in crypto. At the end of July last year, the price of BTC was $34,423.21. Today, it is $43,976. So, the price of BTC has risen by approximately 27.75% in that time. Will it continue its upward trajectory as we get closer to the halving date of April 26, 2024?

What is the Bitcoin halving and why would that make people buy Bitcoin?

Bitcoin miners are people who use powerful computers to solve mathematical equations on the Bitcoin network. When they solve a mathematical equation, they are rewarded with Bitcoin. The more equations they solve, the more Bitcoins they earn.

Having miners solve these equations is not just for fun — the process was designed to keep the Bitcoin network in working order, keeping the system fair and secure for users.

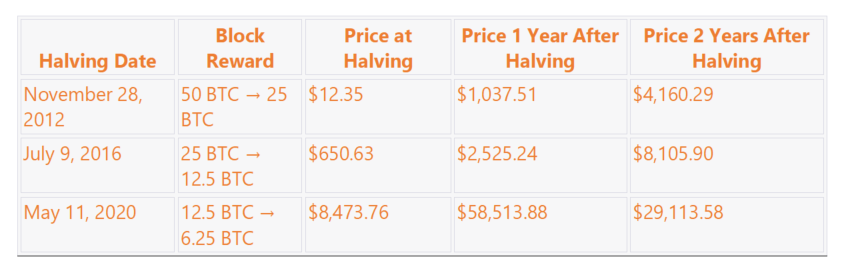

The Bitcoin halving is an event that occurs every four years. It means that the reward for mining new Bitcoins is cut in half. Miners will earn fewer bitcoins for the same amount of work. With a smaller reward, some miners are less willing to mine new Bitcoins. This means there will be less Bitcoin in circulation, and theoretically, this should increase the value of existing Bitcoin, as they become scarcer.

The last Bitcoin halving happened on May 11, 2020.

What will the price do after the Bitcoin halving?

As Bitcoin is a very young asset, it is hard to predict what it will do when certain world events happen. However looking back at previous halvings, we can see that the price has risen sharply after all three halvings. However, this does not guarantee that the same will occur in a year.

So what are traders doing now in light of the upcoming halving? According to the Swyftx cryptocurrency exchange, which is based in Brisbane, last March, there were a lot more people in Australia buying and selling BTC than usual. In fact, so many more people in Australia were buying BTC in March, the price of Bitcoin went up by 22.5%.

The “halving” event theoretically makes bitcoin more valuable, so it is assumed that a lot of people want to buy it before the halving happens.

Swyftx Head of Commercial Operations, Tommy Honan, said in March, “Anticipation around the next Bitcoin halving is suddenly very real. There are no clear and obvious triggers for Bitcoin’s price rise this year beyond some concern around recent turmoil in US banking, so we’re applying the Occam’s Razor rule that the simplest explanation is the most likely. We think the most plausible explanation for Bitcoin’s price movement is anticipation around the halving and that this, in turn, is fuelling local trading activity.”

Ethereum loses the love

According to Swyftx, BTC was the most frequently traded digital asset among their high-volume traders in March. This surpassed Ethereum for the first time in nine months.

“We’re not near all-time high trading territory,” said Honan in March. “But local Bitcoin trades are clearly trending up with hundreds of millions of Aussie dollar denominated Bitcoin trades in March. We hit the one-year countdown to the halving this month and it seems to be a factor impacting Bitcoin price action and national trading activity. Bitcoin trading this month remains elevated on January and February levels and we’re seeing a strong trend towards accumulation, with buy orders outnumbering sells by a factor of three.”

Now in July, we are seeing the result of this renewed activity in the price of “digital gold.”

The figures

According to Swyftx, in March, there was a sharp increase in individual trades by Australian high volume traders: A 17% increase in trades of $20k or more, and a 14% increase in trades of more than $100K.

Bitcoin accounted for 22.53% of total trade volume among Swyftx’s top traders, which was up from 9.45% in February.