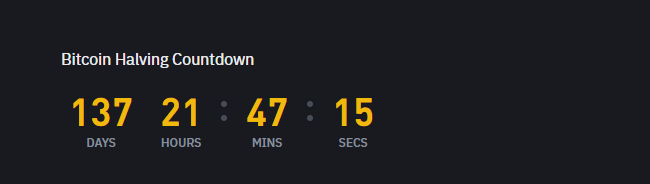

What is the Bitcoin halving? It is a question that will become very relevant in the coming months. Why? Because the next Bitcoin halving will happen around April 7, 2024. And when it does, it will probably have an effect on the price of Bitcoin. So there will be a lot of talk about it as the date approaches.

The Bitcoin halving happens every four years. In this explainer, we tell you what this means and why it is predicted to have an effect on the Bitcoin price.

Table of contents

What is Bitcoin Halving?

Bitcoin is created by Bitcoin miners, or computers that solve complex mathematical problems or “mine” for new Bitcoin. If they solve the problem, they keep the Bitcoin as a reward. Which then get passed on to their human owners!

Unlike regular money, Bitcoin is not controlled by any person or group, but by a network of computers that work together to keep track of all the transactions. These computers are called nodes, and they use a special program to make sure that no one cheats or spends the same Bitcoin twice.

One way that nodes help to keep the network secure is by creating new blocks of transactions. A block is like a page in a book that records what happened on the network. Each block has a link to the previous block, forming a chain of blocks. This chain is called the blockchain, and it is the public record of all the bitcoin transactions ever made. And that’s how we can snoop on what people are doing with their Bitcoin!

Nodes

To create a new block, computers called nodes, have to solve a mathematical problem. The first node to solve the problem is rewarded with some new Bitcoin, which is called the block reward.

The block reward is cut in half every four years to limit the amount of Bitcoin that can ever be created. The block reward is the only way that new Bitcoin are created, and it is how nodes are paid for their work.

A node and a miner are two different kinds of computers that help the Bitcoin system work. A node is like a librarian who keeps a copy of the big book of Bitcoin transactions, called the blockchain.

Also, a node checks if the new transactions are following the rules, and shares the book with other nodes.

A miner is like a puzzle solver who tries to create new pages for the book, by solving hard maths problems. Nodes and miners work together to make sure that the book is always updated and accurate.

Can anyone mine Bitcoin?

Anyone can mine bitcoin, but it is not easy or cheap. Mining bitcoin requires a lot of computer power and electricity, which can be very expensive.

Also, the mathematical problems needing to be solved get harder over time, which means that miners need more and more powerful computers to keep up. This makes mining Bitcoin very competitive and risky, as there is no guarantee that a miner will get the block reward.

The Bitcoin halving

Bitcoin halving is a process that reduces the supply of new Bitcoin created by the network of nodes. It occurs every 210,000 blocks, or approximately every four years. The purpose of halving is to keep the inflation rate of Bitcoin under control and to ensure its scarcity and value. So with every halving that passes, miners get less Bitcoin as a reward.

When Bitcoin was launched in 2009, the block reward for miners was 50 Bitcoin. This means that the first miner to solve a complex mathematical problem and validate a new block of transactions would receive 50 Bitcoin as a reward. However, this reward is not a fixed amount. It is programmed to decrease by 50% every 210,000 blocks. This is known as Bitcoin halving.

The first Bitcoin halving happened in November 2012, when the block reward dropped from 50 to 25 Bitcoin.

The second halving occurred in July 2016, when the reward was further reduced to 12.5 Bitcoin.

The third and most recent halving took place in May 2020, when the reward became 6.25 Bitcoin.

Rewards

While the rewards have gone down in the number of Bitcoin given, loosely speaking, the price of each Bitcoin has mostly gone up. After the halving in 2020, the price of Bitcoin shot up.

The highest price that Bitcoin ever reached was on November 10, 2021, when it was worth US$68,991 per Bitcoin (AU$105,557). This was the peak of Bitcoin’s price history, which means that it was the most expensive that Bitcoin ever was.

However, after that the price of Bitcoin fell to US$16,398 (AU$25,115) in November of 2022. So even though this was after the halving, other factors drove the price drop, like crypto exchanges going bankrupt. Recently, with anticipation of the upcoming halving in 2024, prices have started to rise again.

So as you can see, even though miners get less Bitcoin as a reward for keeping the network functioning, the value of those Bitcoin has increased over the years. And it could continue to increase.

When is the Next Bitcoin Halving?

The next Bitcoin halving is expected to happen in 2024, when the block number reaches 840,000. The exact date is hard to predict, as it depends on a few different factors. However, the estimated date is April 7, 2024.

You can check the current progress and countdown of the next Bitcoin halving on various websites.

What are the Effects of Bitcoin Halving?

Bitcoin halving has significant implications for the network, the miners, and the market.

Network security

Bitcoin halving affects the profitability and incentives of the miners, who are responsible for securing the network and validating transactions. When the block reward decreases, some miners choose to stop mining or switch to other cryptocurrencies.

This could make the network more vulnerable to attacks or delays. However, this effect is usually temporary.

Miner revenue

Bitcoin halving reduces the income of the miners from the block reward, which is their main source of revenue. To compensate for the loss, the miners may charge higher fees for processing transactions, or rely on the appreciation of Bitcoin’s price.

The fees are determined by the supply and demand of the network’s limited space, and the price is influenced by various factors, such as supply and demand, market sentiment, innovation, regulation, and adoption.

Bitcoin supply

Bitcoin halving limits the growth of the Bitcoin supply, which is capped at 21 million. There are currently around 19.4 million Bitcoin in circulation. This amounts to approximately 92% of the total supply of 21 million Bitcoin that can ever exist. The remaining Bitcoin are yet to be mined.

However, some of the Bitcoin in circulation are believed to be lost forever or unspendable, because of mistakes like lost passwords, or simply using the wrong address when transferring them. Therefore, the actual number of Bitcoin that are available for use may be lower than the number of Bitcoin in circulation.

Lets not get too panicked about scarcity just yet though. It is estimated that the last Bitcoin will be mined in the year 2140, when the block reward becomes zero. At that point, the miners will only earn from the transaction fees, and the Bitcoin supply will become completely fixed.

Bitcoin price

This is what everyone wants to know! How does the Bitcoin halving affect the price of Bitcoin? It does this by altering the balance between supply and demand.

According to the economic theory of supply and demand, when the supply of an item decreases while the demand remains constant or increases, the price of the good tends to rise.

As a colourful example, check out this tale about pineapples and scarcity, it is mind-boggling. In a similar vein, many people think that Bitcoin scarcity will similarly drive up the cryptocurrency’s price.

This is based on the assumption that the item is scarce, useful, and divisible, which are all true for Bitcoin.

This leads many analysts and investors to waffle that Bitcoin halving creates a bullish scenario for the price of Bitcoin, as it reduces the inflation rate and increases the scarcity of the cryptocurrency.

However, the price of Bitcoin is not only determined by the halving, but also by other factors, such as market sentiment, innovation, regulation, and adoption. And sometimes, it just does something unexpected, for no reason that anyone can put their finger on.

And of course, the halving is not a surprise event, but a predictable and transparent one. Therefore, the market may have already priced in the halving effect.

Price history after Bitcoin halvings

The historical data (not that there is a lot of that… Bitcoin was only thrown out into the world in 2009) shows that the price of Bitcoin tends to increase before and after the halving, but also experiences high volatility and corrections.

Historically, Bitcoin’s price has shown both pre-halving rallies and post-halving corrections. For example:

2012 Halving

Pre-halving: Bitcoin experienced a significant increase in price.

Post-halving: The price initially surged but then saw a drop.

2016 Halving

Pre-halving: Bitcoin price increased leading up to the event.

Post-halving: The price initially surged, followed by a correction.

2020 Halving

Pre-halving: Bitcoin witnessed a substantial price increase before the halving.

Post-halving: The price showed huge volatility, including both an increase and a subsequent drop.

Historical trends are cool and all, and they can sometimes provide some insights. But remember kids, they do not guarantee what will happen in the future. The crypto world is a crazy place.

Conclusion: Bitcoin halving

In line with Bitcoin price history, the price of Bitcoin has been rising as we head toward the next halving event in April 2024.

However, always keep in mind that crypto markets are still very, very young and they are wildly unpredictable.

If in doubt, instead of buying some Bitcoin, maybe just go hangout at a Bitcoin Halving Party, it seems like it will be a lot of fun!