Fear and greed index: As a banking crisis unravels around the globe and fears of widespread contagion wreaks havoc on traditional markets, major cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH) have been witnessing some major upwards price action, surging 30% and 25% respectively over the last seven days.

At the time of writing, Bitcoin is changing hands for US$28,313, marking the highest price it’s reached since early June last year. Similarly, Ethereum is trading at US$1,811 apiece, its highest price since mid-August, 2022.

While Ethereum is typically the more volatile of the two major cryptocurrencies, Bitcoin has shown a surprising dominance over the past few weeks, as fears around the stability of major banking institutions drive investor funds into the flagship crypto asset, which is being marketed by its proponents as a ‘safe haven’ asset.

Former Coinbase chief technology officer and serial entrepreneur Balaji Srinivasan has made an incredible public bet, predicting that Bitcoin could reach an incredible price of US$1 million per Bitcoin all within the next 90 days. Srinivasan claims that the current banking crisis will cause “hyperinflation” of the US Dollar and that investor funds would be far safer in a decentralised asset like Bitcoin, as opposed to regular fiat currency.

Balaji’s incredible bet took the crypto space by storm and drove a wave of fresh investment into Bitcoin. While the reasons are numerous, Balaji’s fervent support of the asset can be seen as one of the driving factors behind why the ‘Crypto Fear and Greed Index’ tipped over into the ‘Greed’ zone for both Bitcoin and Ethereum.

What exactly is the crypto Fear and Green index?

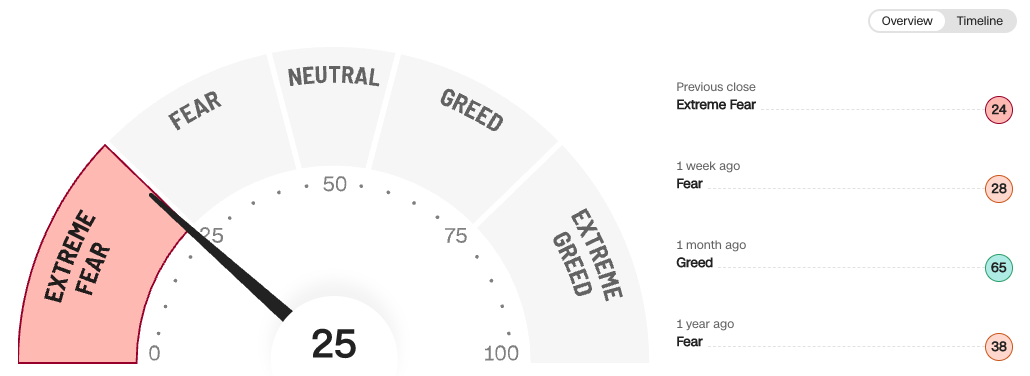

The cryptocurrency Fear and Greed Index stands in stark contrast to that of traditional markets, with CNN Business’ Fear and Greed Index showing that the average investor in stocks, bonds and equities seem to be extremely fearful.

Fear and Greed index explained

Much like all markets, investment in cryptocurrency is largely governed by the emotions of investors. When prices are going up, people become enthralled with the idea of making money and lean towards being ‘greedy’. Contrastingly, when prices go down, investors have a tendency to sell as fear of losing money takes over.

According to the Fear and Greed Index official website, there are two simple assumptions that govern price activity in the crypto market:

- Extreme fear can be a sign that investors are too worried. That could be a buying opportunity.

- When investors are getting too greedy, that means the market is due for a correction.

The index analyses data from a number of sources, including overall price volatility, surveys, social media sentiment and Google trends data to figure out where investors emotions are at, and ranks them between “extreme fear” (indicated by a value of 0) and “extreme greed” (indicated by a value of 100).

With such contrasting readings on the respective Fear and Greed Indexes between crypto and regular markets, do everyday investors have a good reason to be fearful, or would it be wise to start getting greedy?

What happens to investors in Australia?

In conversation withThe Chainsaw, Investment Manager at fintech startup Blossom Christian Baylis shares what he believes international markets have in store for Australian retail investors.

“Australia will be caught in the vortex of what happens offshore – because ultimately we find ourselves in international markets. As the saying goes, the US sneezes and we catch a cold. In practical terms, this will mean lower equity markets and a more restrictive funding environment,” said Baylis.

While many are understandably concerned that the banking crisis may unfold to become something that looks a lot like the banking collapse we saw during the Global Financial Crisis of 2008, Baylis warns that this time looks to be quite different.

“We don’t believe this is the beginning of another crisis like the GFC. In fact, it is a different issue altogether.

Christian Baylis, Blossom.

“Banks are better placed today than they were back in 2008, but that said, it is all about how people respond to a crisis and this can be difficult to predict. At the moment, the response has been quite dramatic and, while the root cause is reasonably innocuous, the response has been anything but that,” Baylis explains.

Fear and Greed Index

Gaby Rosenberg, co-founder and CEO of Blossom, tells The Chainsaw that while the banking turmoil in the United States is definitely cause for concern, Australian banks operate under stricter regulatory controls and are more equipped to deal with any potential financial contagion.

“While Australian banks operate under tighter regulations and boast greater strength, Credit Suisse’s struggles will still have consequences here. The situation contributes to market volatility and weakens investor confidence,” Rosenberg shares.

Additionally, Rosenberg believes that it would be wise for everyday Aussie investors to start looking at some “defensive strategies” in the face of the growing uncertainty.

“Weak banking systems can erode investor confidence and the current market sentiment has led investors to reassess the stability of major financial institutions. In the face of uncertainty, investors often re-evaluate their portfolios and adopt defensive strategies.”