The Australian Stock Exchange (ASX) has released its annual Australian Investor Study right before the end of the financial year. According to the report, crypto is the most popular among Gen Z Aussie investors aged 18 to 24 with 31% of the group holding on to ‘magic internet money.’

The study, conducted by the ASX in November 2022, surveyed 5,519 Australian adults who invest or plan to invest in an asset over the next 12 months. The result? Gen Z investors are among those who are most interested in crypto as an emerging investment.

Crypto by popularity and attitude

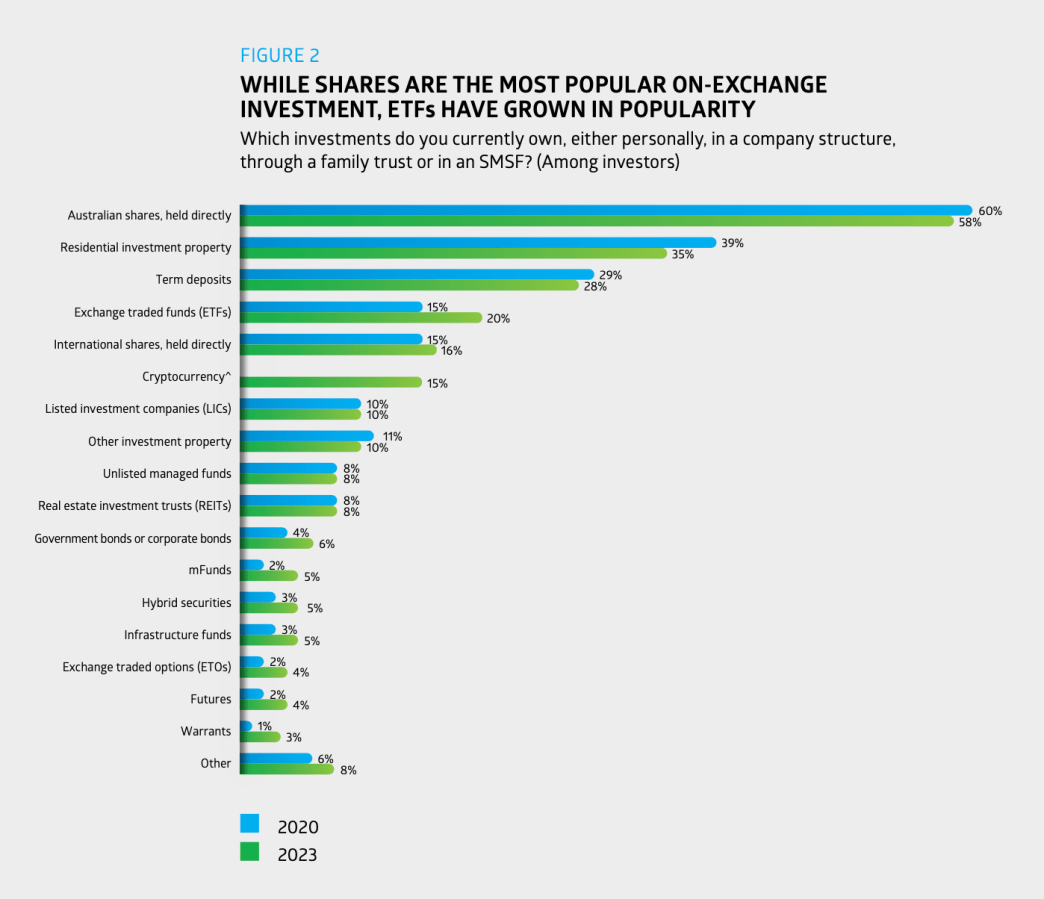

Overall, 51% or 10.2 million Australians hold investments in 2023, making us “a nation of investors,” claims the ASX. Crypto is one of the top ten most popular investments among Australians, with 15% of investors owning crypto. However, this still puts crypto behind ‘traditional’ assets such as direct Australian shares (58%), residential investment property (35%), term deposits (28%) and ETFs (20%).

From the chart below, we can see that crypto – despite having been around for over a decade – is finally included in the survey for the very first time.

The ASX has also observed that, compared to other investors, crypto investors exhibit “a clear difference in attitude towards financial risk.” Crypto investors are “more likely to accept higher variability with potential for higher returns (20% vs. 10%).” In other words, we’re all diamond hands, baby.

Unsurprisingly, Bitcoin and Ethereum are the most widely-known and traded crypto assets as of May 2023, according to the report.

Crypto by amount

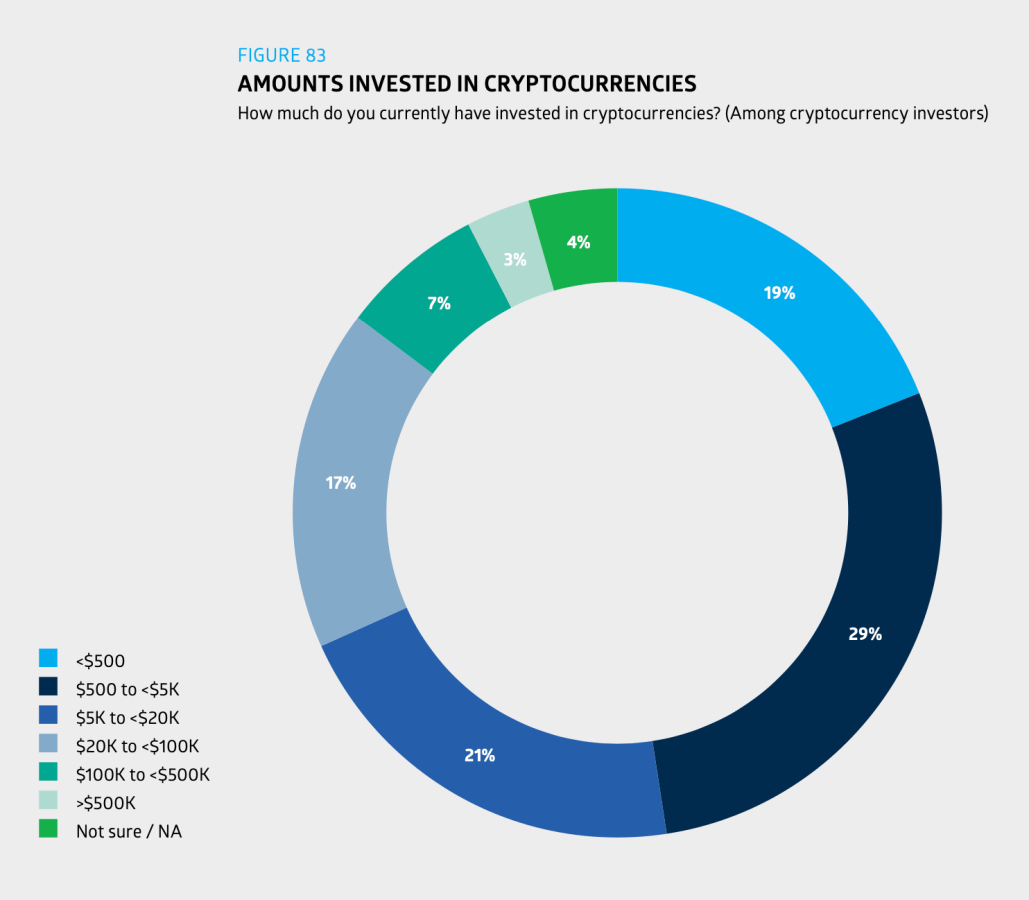

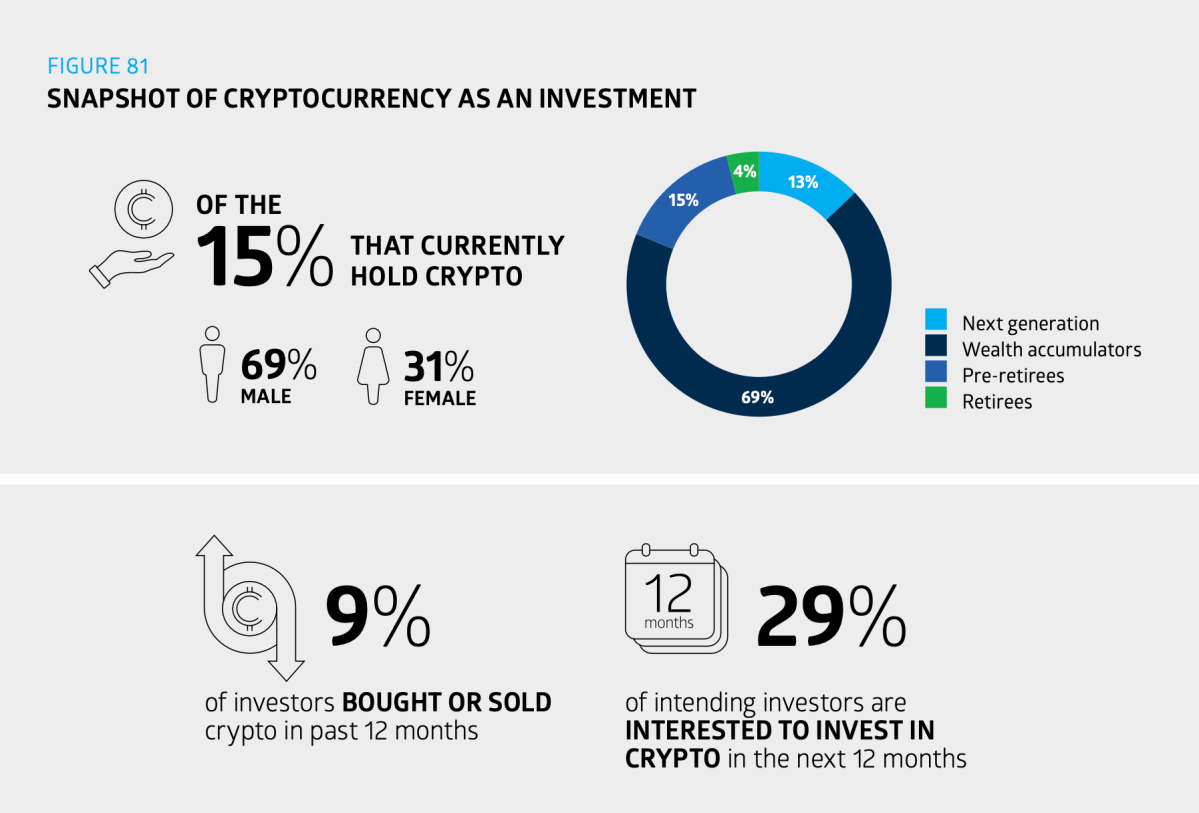

Of the 15% of Australian investors holding crypto, 31% are Gen Z Aussies. So, how much money do these investors pour into crypto? A small amount compared to other assets in their portfolio, says the ASX report. The median value of an Aussie’s crypto holdings is AU$5,100, or just a baby 3% of their entire portfolio.

Nearly a third (29%) of crypto investors have between AU$500 to AU$5,000 invested in crypto. One fifth (21%) have AU$5,000 to AU$20,000 invested in crypto, and only 3% of all crypto investors have at least half a million dollars in crypto holdings. Pure degens, if you ask us.

Crypto by gender

The term ‘crypto bros’ exists for a reason. The ASX’s study reinforces the perception that the crypto scene is male-dominated. Of all Aussie crypto investors, 69% (nope, not a gag at all) are male, and 31% are female.

Male investors also dump much, much more money in hopes of going to the moon. Bros invest a median of AU$8,300 in crypto, compared to women who invest AU$1,700.

“This could be explained by the difference in attitude towards financial risk between men and women,” notes the report. “Another potential driver for the gender disparity in money invested is their respective investment goals with males showing greater interest in maximising capital growth (17% for male vs. 11% for female).” the ASX’s report adds.

Crypto exchanges still dominate

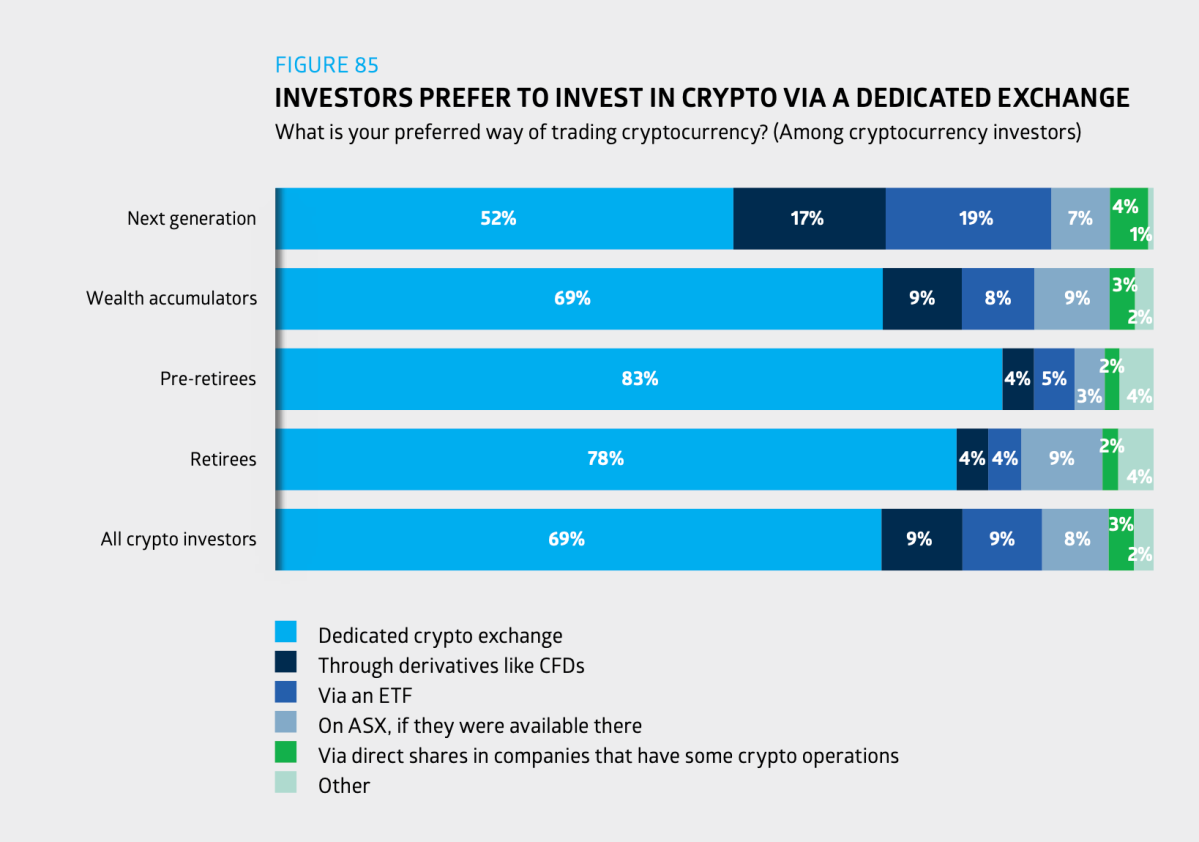

FTX burned to the ground? Binance is in hot water? Doesn’t matter, apparently. This is because crypto exchanges are still the preferred route for investors to buy and sell crypto. 52% of next generation investors say a dedicated crypto exchange is where they go to get their hands on magic internet money. An overwhelming 82% of pre-retirees use crypto exchanges, too.

“Comparing survey responses to this question before and after the [FTX] crash revealed it didn’t dampen enthusiasm for trading via dedicated cryptocurrency exchanges. Surprisingly, the number of crypto investors who prefer to trade cryptocurrencies this way rose from 67% to 78%,” confirms the ASX.

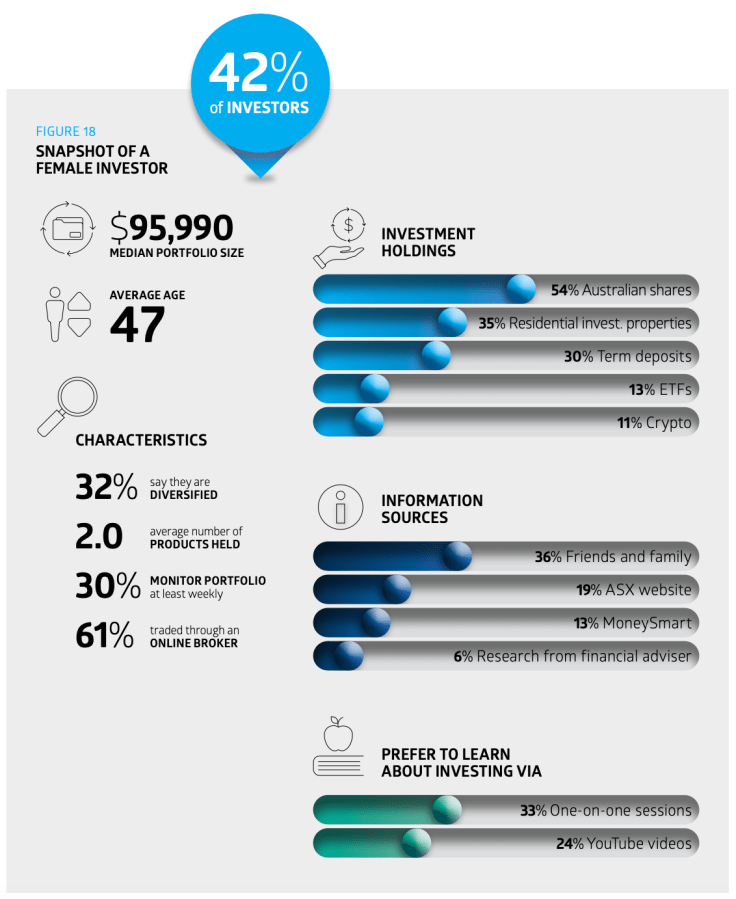

Female investors are on the rise

In all, despite being an asset class known for its heart attack-inducing volatility, crypto’s popularity among investors remains strong, says the report.

And in good news, more Aussie women are also moving into investing. Of the reported 1.2 million new investors in the market, around 600,000 were women. In addition, “the percentage of next generation female investors rose from 9% in 2020 to 11% in 2023 – a small but positive move in the right direction,” notes the report. Yas, queens.

However, there is still much more to do when it comes to closing the inequality gap in investing. Male investors have an average portfolio of AU$667,000, compared to women who have an average of AU$413,000. 31% of female investors also have balances below AU$50,000.

The future looks promising, overall

The ASX’s report states that “Australia’s investors continue to thrive”, and more finance bros and chicks than ever are “branching out into other vehicles like international shares and cryptocurrency.”

“Looking forward, this indicates that the future of investing in Australia is promising,” the report concludes.