Nobody knows the future, in the end it comes down to probabilities. And based on what I’m seeing from the latest lower-than-expected consumer price index (CPI) data, I believe that the crypto market bottom is very close. Furthermore, I believe that Bitcoin (BTC) has a strong chance of reversing course in 2023. Here are my reasons why.

CPI and QE (quantitive easing)

Due to the higher-than-expected terminal interest rate and the expectation of economic recession, the Fed has a high possibility of turning to a dovish monetary policy and starting QE in advance.

The U.S. CPI rose 0.1% in November from the month prior, slowing more than expected from October’s 0.4% pace, in a sign of progress in the Federal Reserve’s campaign to bring down soaring inflation. CPI remains 7.1% year-on-year, yet down from 7.7% from the month before.

BTC jumped 1.6% in the minutes after the report was released, to around US$17,930. This seemed like a market reversal. Shortly after the release of CPI data, the Federal Reserve hiked rates in December by 50 basis points (bps). For reference, 100 bps or basis points is equivalent to 1%. So when the Federal Reserve increases rates by 50 bps, it is referring to an increase of 0.5%.

As soon as the Federal Reserve hiked rates in December, BTC fell by 2.5% within an hour.

Is the reversal really coming? Let’s look at the interest rate first.

What is the impact of the Fed’s interest rate hike on crypto markets?

Data from US Department of Labour shows the unemployment rate at the time was much higher than the 3.5 per cent that had prevailed without major signs of tightness before the pandemic.

Employment was still millions below its level on the eve of the pandemic. There is a significant and persistent labour supply shortfall that opened up during the pandemic — a shortfall that appears unlikely to close anytime soon fully.

Both fuel and non-fuel import prices have fallen in recent months, and indicators of prices paid by manufacturers have moved down. The core goods inflation has fallen nearly three percentage points from early 2022.

Current economic indicators and statistics show the possibility of economic recession – everything including labour markets, supply chains, the inverted yield curve (explained here), interest rate policy and fiscal spending, Therefore, market bets on a 50 bps (0.5%) hike in December rose to 77% from 66% previously, strengthening the dovish expectations (i.e. that the Federal Reserve would start easing interest rate hikes).

BTC jumped about 1% on the news to US$16,982, whereas US stocks soared, led by the Nasdaq Composite Index, which was up by as much as 4% after Powell’s dovish tone in the speech.

The other major indexes also spiked on the Fed chief’s comments. The Dow Jones Industrial Average surged 737 points and the S&P 500 ended up more than 3%. BTC slightly decoupled from US stocks.

In general, the cryptocurrency market’s price decline has become less and less affected by the Federal Reserve’s interest rate hike. At least from what I can tell.

The Federal Reserve officially began to discuss the issue of interest rate hikes from January 25 to 26, 2022. The core issue is mainly solving the economic problems caused by the expansion of US dollar liquidity since 2020. Since the first rate hike announced on March 26, BTC prices have been increasingly unaffected by rate hikes.

| Rate hike date | 3.26 | 5. 4 | 6.15 | 7.27 | 9.21 | 11.2 | 12.14 |

| rate hike basis | 25bp | 50bp | 75bp | 75bp | 75bp | 75bp | 50bp |

| BTC price fluctuations | 10.59% | -49.54% | -30.3% | 13.8% | -9.5% | 3.5% | -2.5% |

When it comes to stocks, interestingly, looking at historical data from the US stock market, sell-offs still happen even with super low interest rates, like we saw in the 1950s and again since 2004. Recessions followed rate hikes.

The average correction in the S&P 500 during rate hikes is around 15%. In contrast, when there is a recession (even if it overlaps with a rate hike cycle), the average drawdown in stocks is almost double (blue circles and bars).

Inflation conversion usually brings economic weakness. After quantitative easing, US stocks often have room to decline, because the market perceives that the Fed has started to release liquidity due to the bad economy.

So in short, it seems we should worry much more about a recession after rate hikes.

Based on the growing inverse correlation between BTC and the macroeconomy, the real question is: can BTC decouple from US stocks?

What signals can stablecoins and total value locked data bring us?

Another factor to observe is the stablecoin market capitalisation (market cap). After weeks of chaos, the crypto market continues to remain volatile. The general trend is still a bear market, and there has been a small rebound at the daily level, but the rebound is not a reversal.

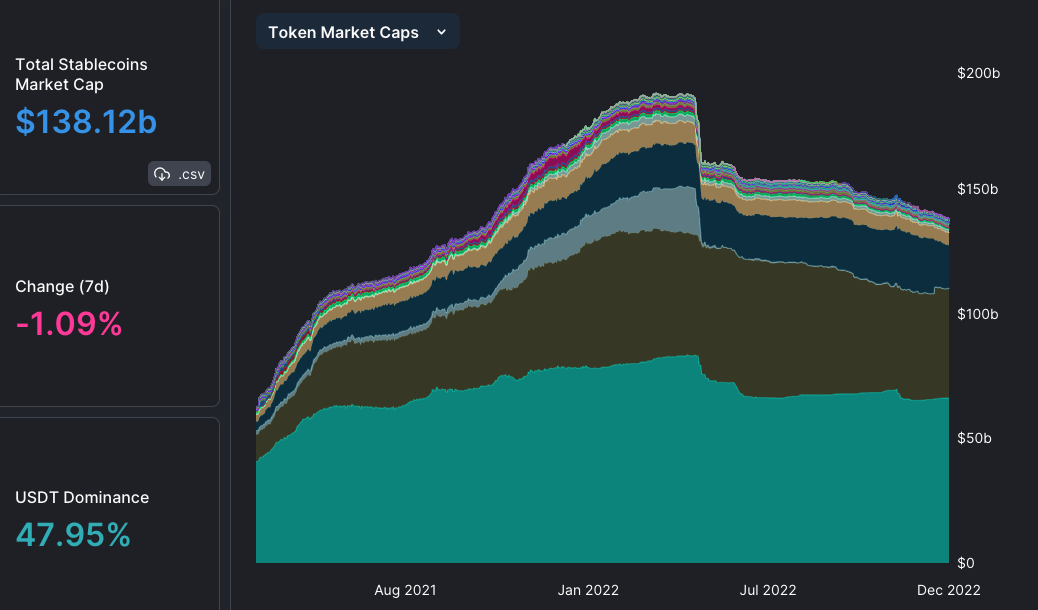

The market reversal signal needs to see the market cap of stablecoins grow, which means that new funds are entering the market. According to data from DefiLlama, the total market cap of stablecoins is around US$138 billion, around half of what it was from the peak.

We can’t see the money signals needed for a market reversal yet.

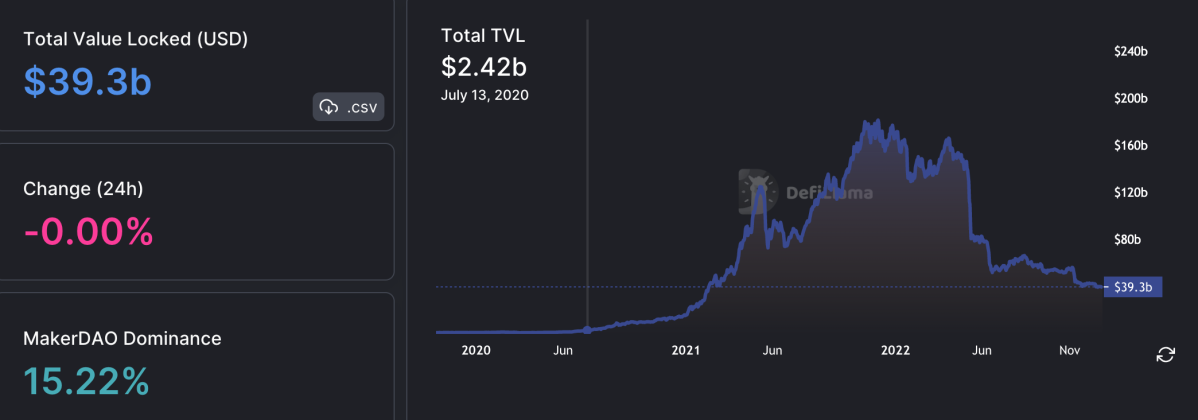

Total value locked (TVL) is also a preventive indicator to predict market flows. According to DefiLlama, the total TVL from the market is around US$42 billion.

The total TVL from last week increased by US$0.63b, and the overall weekly increase was 1.5%. Among them, the TVL of Ethereum rose by 3.72%. Solana gained 6.97% for the week after three weeks of declines, but only accounted for 0.72% of TVL.

BSC fell by 4.02% last week, Layer2’s public chain Arbitrum rose by 2.25%, Polygon rose by 0.94%, Avalanche rose by 3.18%, and Optimism fell by 1.16%. Roughly flat TVL suggests no capital injection in the market, no signs of activity.

The potential risks from FTX aftermath

In addition to the lack of capital, there still exists potential risks from FTX aftermath. Most of the liquidity in the crypto market was dominated by several large market makers including Alameda, Wintermute, Amber Group, Genesis and others.

When Alameda announced the suspension of trading, market liquidity plummeted. What’s worse, following the FTX collapse, Amber Group, Wintermute and Genesis also announced that their funds were trapped on FTX. Retail investors fled in panic to avoid further contagion. These factors further exacerbated the overall market liquidity crunch crisis.

Alameda had invested in dozens of projects and held millions of dollars. Meanwhile, Alameda was also the market maker that provided liquidity for these projects. When FTX and Alameda imploded, market liquidity collapsed. In fact, the collapse of FTX almost withdrew one-eighth of all market liquidity.

Both Genesis and Grayscale belong to DCG. Genesis suffered a loss of US$1 billion, Grayscale’s GBTC has lost its competitiveness due to negative premium, and no one subscribes to it anymore. The market could fall further if Grayscale’s locked BTC is redeemed. DCG may face a problem of insolvency, which will result in further market panic.

Is the crypto market bottom in? Wen reversal?

Macroeconomic recovery is a necessary factor. CPI data is a lagging indicator, which is a very good sign for cryptocurrencies and other risk assets. It does not mean that the bottom of the cryptocurrency market is fully formed, but it is clear that the bottom is very close.

According to Powell’s speech on December 14, the extent of the rate hike in February 2023 depends on data and the labour market, with either 25 or 50 bps increases being possible.

The full impact of the tightening has yet to be felt, but the economy has slowed considerably compared to last year. The Fed wants a gentle way to recover price stability, but no one knows if the economy will go into recession.

From the latest forecast released by the Federal Reserve, most officials see terminal interest rates at 5%-5.5%, much higher than forecast in September.

The market will bear the risk of economic recession to a large extent. Therefore, the Fed has a high possibility of turning to a dovish monetary policy.

My expectation for BTC’s price reversal is based on the projected dovish monetary policy in 2023 to stabilise the US Treasury market.

I’m not sure if US$15,900 is the BTC bottom. However, I am confident that the bear market is being caused by forced selling due to the credit crunch. I’m not sure when or if the Fed will start QE again. However, the US Treasury market will become dysfunctional sometime in 2023 as the Fed tightens monetary policy. At that point, I expect the Fed to restart QE. BTC and other risk assets will likely skyrocket by then.

The development of a bull market is inseparable from the birth of new assets and scenarios. The implementation of new scenarios requires stronger public chain performance support. With the birth of new public chains, more maturity of Layer2 solutions, and the improvement of infrastructure, the market will have hope of a bright start in 2023.

However in the final analysis, a strong bull market requires a breakthrough in technology and a loose macroeconomy. Only when these things change will we know for sure that the crypto market bottom is in.