Crypto winter: As 2022 rapidly draws to a close, many investors in the digital currency ecosystem will remember it as one of the most painful years on record, or at least the chilliest crypto winter on record. Unfortunately, we saw a lot of bad things happen throughout the year, many of which made regulators all over the world sit up and pay closer attention.

Despite the industry enjoying some significant milestones in terms of new trends, the overall liquidity crisis overshadowed these positive events, serving to dampen industry sentiment across the board. What then to make of this year?

Ethereum versus Bitcoin competition heats up

Since its inception, Ethereum (ETH) has posed a formidable challenge to Bitcoin (BTC). Not that ETH is anywhere close to the latter in terms of market capitalisation, but the network’s relevance as a hub for applications has made it the most used blockchain today.

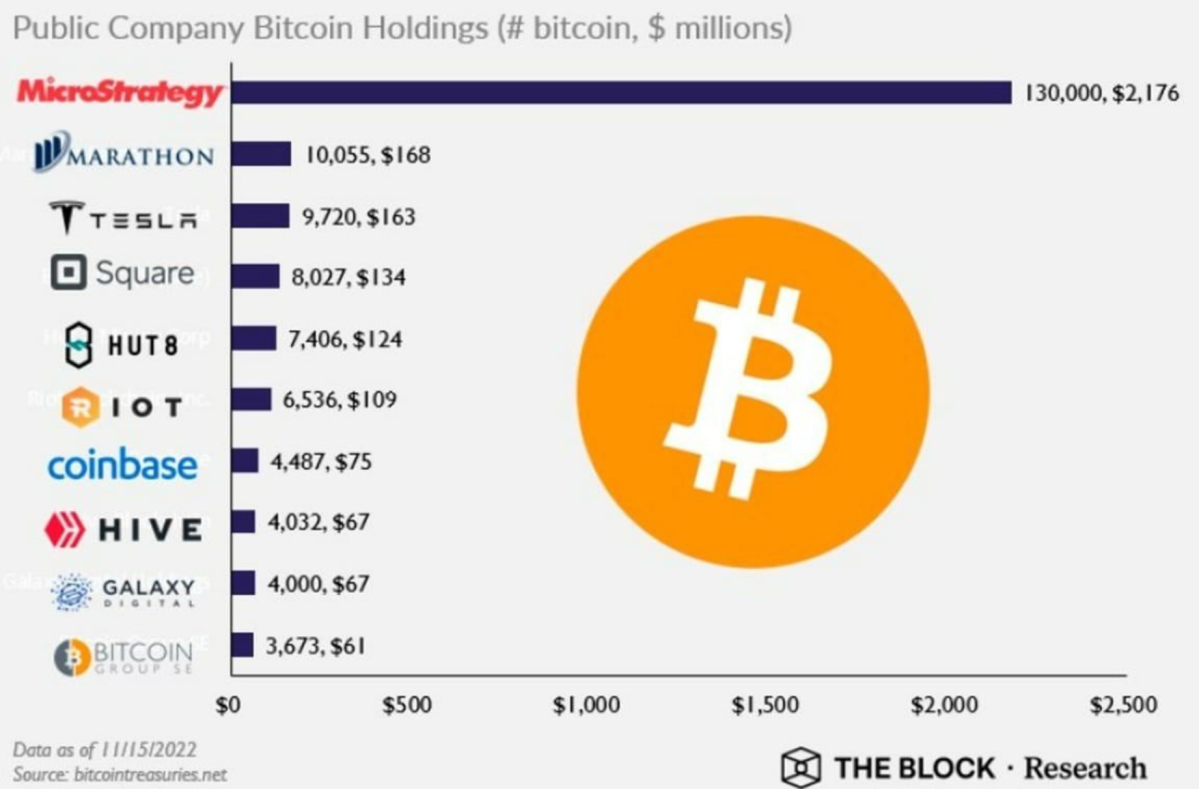

In its bid to become positioned for the future, Ethereum passed through The Merge this year, transitioning from the Proof-of-Work (PoW) consensus model to the Proof-of-Stake (PoS), making it a highly energy-efficient public blockchain network. While Ethereum is making progress in this area, Bitcoin has established itself as a safe-haven asset and is gradually making its way onto corporate balance sheets – MicroStrategy of course being the biggest holding over 130,000 BTC.

In 2023, regular improvements will likely continue to make Ethereum more valuable. I also expect Bitcoin to maintain its position as the most valuable digital currency, and in that process, I foresee its price rising to a new all-time, exceeding US$69,000.

But then again, we are talking about a crypto winter that has been as frosty as ever, so price predictions are inherently challenging.

Crypto winter claims the lives of FTX, Celsius, 3AC and more

The crypto industry started the year with so much optimism, however, things seemed to start going awry shortly after the outbreak of war. It truly upended everything, and this trickled down to the financial markets, with the crypto sector inevitably being impacted as a result. And not in a good way.

The market downturn and the de-pegging of TerraUSD (UST) earlier in the year fuelled the collapse of Three Arrows Capital (3AC). Meanwhile, hot on their their heels, Celsius Network and Voyager Digital also filed for Chapter 11 bankruptcy in the US. As if that weren’t enough, the ostensibly “healthy” crypto exchange behemoth FTX declared bankruptcy.

Going into 2023, we should expect further contagion from the FTX implosion. Well, at least I am. However, I am also of the view that this positively freezing crypto winter will not last long or be widespread, and that soon enough, investors will rebuild their trust in exchanges and embrace those who have transparently proven their cash reserves.

Good news: mainstream businesses embrace Web3

In 2022, more mainstream businesses began to embrace Web3 innovations. Nike, Lacoste, Salvatore Ferragamo, and Budweiser all floated NFT collections to create communities and connect more with their fans.

in addition, many retail outlets have also started accepting cryptocurrencies as a means of payment, solidifying their balance sheets with Bitcoin, Ethereum, and stablecoins.

Critics argue that blockchain and Web3 innovations going mainstream is a myth or overblown. But I expect more companies to ride the Web3 wave in 2023, especially as we’ve seen financial services firms like JPMorgan embrace decentralised technology.

Web3 is a trend, and companies will follow it in order to grow, attract more attention, and avoid being left in the dust.

Regulators taking a much closer look at crypto

Global market regulators such as the US’ Securities and Exchange Commission (SEC) and the Financial Conduct Authority (FCA) of the UK are clearly shining their beams more intensely on the industry than ever before.

But I think that this is necessary, especially considering the billions of dollars lost from declining prices, not to mention capital locked up (or lost) in bankruptcy proceedings abroad. The call of the SEC for comprehensive regulation is currently being echoed by industry stakeholders and lawmakers. And it’s about time.

As an illustration, according to a recent report by the Financial Times, the FCA has finalised plans to further tighten crypto regulations in the UK and will limit how foreign exchanges operate or ply their trade in the nation.

It seems that globally, regulators will do their best to protect their markets from the mishaps that befell the crypto industry in 2022. As for next year, I’d argue that we can expect more increasingly heavy-handed regulations to be introduced.

Crypto winter: Be prepared for an exciting future

The harsh crypto winter experienced this year is not the end of the crypto ecosystem. Period. It is an opportunity to separate the wheat from the chaff. Every day, new protocols are introduced, and in the coming years, I expect the industry to grow even more.

The world is appearing extremely unstable right now, and each industry, including IT, e-commerce, energy, and so on, is experiencing a crisis in its own way. As a result, businesses must be adaptable and find solutions for all scenarios.

But one thing is certain: every crisis causes a quantum leap forward, and only the strongest survive. Bring on 2023.