As eyes across both traditional and crypto financial industries look to evaluate the aftermath of the FTX collapse, many are recognising that it wasn’t only retail customers that were left high and dry by the unceremonious collapse of the empire. A plethora of companies, hedge funds and investment managers entrusted FTX with their capital – of course in hindsight, that has since proved to be a grave mistake.

With losses continuing to emerge, we decided to zoom out for a moment and ask the question: who got most rekt by the FTX implosion?

What we know so far

According to a report by Crypto Fund Research, the company found that on average, 25-45% of crypto-focused hedge funds have some direct level of exposure to either FTX or its native token, FTT. Based on the research, it was found that between 7% and 12% of assets under management were exposed to FTX.

Speaking to Blockworks, Crypto Fund Research CEO Josh Gnaizda said:

“When the smoke clears, we expect the losses from crypto hedge funds and crypto venture funds directly exposed to the FTX collapse to have associated losses of well over $1 billion and possibly as much as $5 billion”.

Crypto Fund Research typically reports on a monthly basis on around 100 funds, and according to reports, the CEO has received dozens of updates from those impacted by the carnage.

Crypto deleveraging events take time to play out, meaning the total impact of FTX’s demise will remain unknown for the time being. Notwithstanding, several firms have come out to disclose their exposure, with some feeling the pain far more than others.

The declared losses

The bodies keep surfacing as more information comes to light. Some were invested in FTX, others in Alameda Research, with many being exposed to FTX by either holding its FTT token or crypto on its platform.

It is highly likely that every investor in FTX is in the process of writing off its investment. Same for those who left digital assets on its platform. These are the most notable names that have cropped up in the midst of all the chaos:

- Crypto hedge fund Galois Capital declared that it had around half of its assets trapped on FTX, estimated to be worth around US$100 million.

- Crypto venture capital firms Paradigm and Sequoia Capital are said to have exposure to FTX of around US$278 million and US$213 million, respectively.

- Digital asset trader Genesis said in a tweet that its exposure to the exchange amounted to US$175 million.

- Galaxy Digital CEO Michael Novogratz said during an earnings call that his firm had roughly US$77 million of cash and digital assets with FTX, adding that more than half of that was in the withdrawal process.

- Crypto investment manager CoinShares said that its total exposure to FTX amounts to roughly US$30.3 million.

- The venture capital arm of the Ontario Teachers’ Pension Plan, which put US$95 million into FTX, has written off its investment, saying, “Not all of the investments in this early-stage asset class perform to expectations”.

- US investment giant Tiger Global lost around US$38 million from its investment in FTX.

- Japanese investment conglomerate Softbank revealed it had written off its US$100 million investment in FTX.

- Private equity firm Thoma Bravo took a major knock with the software-focused firm losing US$130 million in its FTX investment made in July 2021.

- Crypto Fund Research has also reported that crypto investment manager Pantera Capital has around US$100 million in exposure to FTX, however this is yet to be formally recognised by the crypto giant.

- Beleaguered exchange Celsius who is itself knee-deep in bankruptcy proceedings, declared via Twitter that it had around US$1.3 million locked on FTX and around US$13 million in under-collateralised loans to Alameda Research.

- Crypto lender BlockFi appears to also be caught in the crossfire, recently pausing customer withdrawals, although reports have surfaced that some customers are seeing their withdrawal requests being redeemed. Worryingly, in an email to users the firm noted that it had a US$400 loan facility with FTX’s sister company, Alameda Research. The details at this point remain unclear.

- Major crypto venture capital firm Multicoin Capital said in a letter to partner’s of the firm’s “Master Fund” that about 10% of that fund’s total assets under management locked in pending withdrawals on FTX. The letter did not specify the dollar amount of assets locked on FTX.

- Singapore’s state investment fund—Temasek—has written off its entire US$275 million that it invested in FTX.

- Voyager Digital, the bankrupt crypto lender had a balance of roughly US$3 million on FTX when the latter filed for bankruptcy.

- Solana Foundation revealed that it held roughly US$1 million worth of cash or its equivalent -less than 1% of its assets- on bankrupt crypto exchange FTX as of November 6 according to a blog post. According to the Foundation, it also had 3.43 million FTX tokens and 134.54 million Serum (SRM) tokens on the exchange before it stopped processing withdrawals. The Foundation stated that it also held 3.24 million shares of FTX Trading LTD common stock. Cumulatively, the crypto assets were worth around US$190 million before the exchange’s liquidity crunch, but their value has now dropped to less than US$35 million. On paper Solana Foundation lost US$155 million, including the value of FTT token’s collapse.

- Coinbase Global Inc said in a blog post on November 8 that it had US$15 million worth of deposits on FTX. It said it had no exposure to FTT, no exposure to Alameda Research, and no loans to FTX.

- Singapore-based crypto exchange Crypto.com said on November 14 its exposure at the time of FTX’s collapse was less than US$10 million.

- Cryptocurrency exchange Kraken said on November 10 that it held about 9,000 FTT tokens on the FTX exchange and was not affected “in any material way”.

Virtually anyone who invested in FTX is likely to write off their investment, so one ought to expect more announcements to be made.

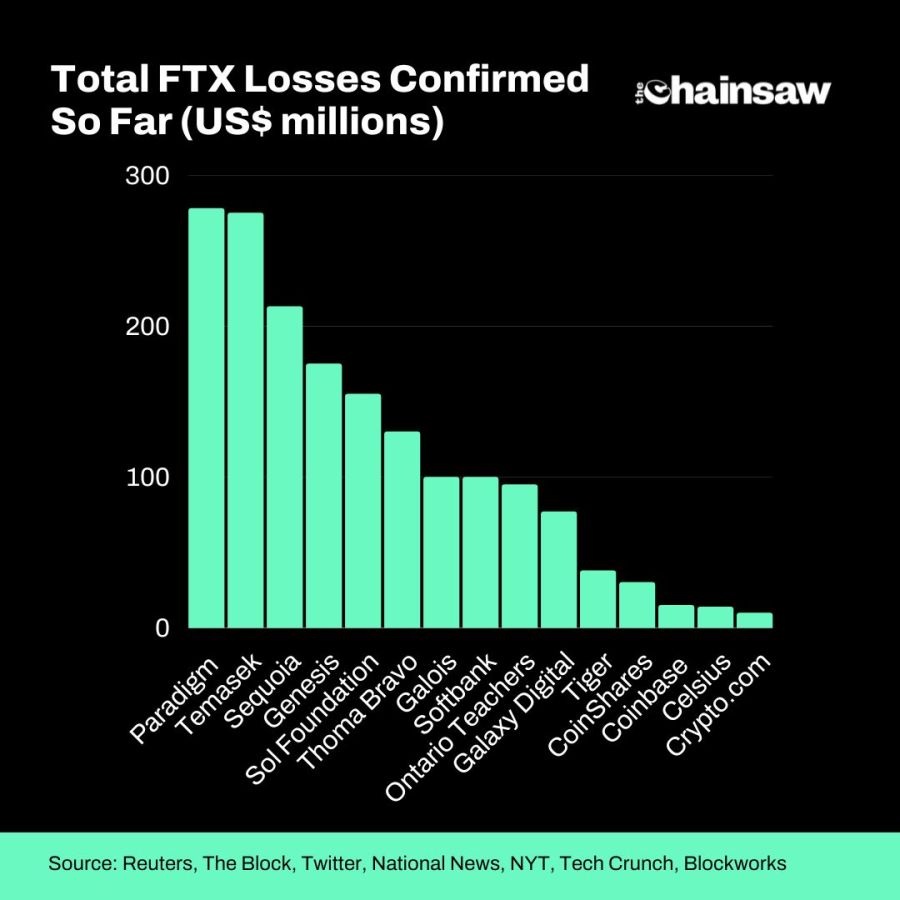

The biggest losers ranked

Based on publicly available information and confirmed losses, the leadership stands as follows:

- Paradigm – US$278 million

- Temasek – US$275 million

- Sequoia – US$213 million

- Genesis – US$175 million

- Solana Foundation – US$155 million

- Thoma Bravo – US$130 million

- Galois Capital – US$100 million

- Softbank – US$100 million

- Ontario Teachers’ Pension Plan – US$95 million

- Galaxy Digital – US$77 million

- Tiger Global – US$38 million

- CoinShares – US$30.3 million

- Coinbase – US$15 million

- Celsius – US$14 million

- Crypto.com – US$10 million

Total confirmed losses amount to US$1.7 billion thus far, with the breakdown by investor as follows:

While Paradigm presently takes the crown for the biggest loss stemming from the FTX meltdown, the most egregious is surely the Ontario Teachers’ Pension Plan.

Crypto investment firms and their investors have a reasonable understanding of the risks baked into their investments. Can the same however truly be said of the teachers whose pensions were invested in a speculative company such as FTX? Probably not.

As more information comes to light, we’ll keep the FTX loss leaderboard updated.