A multinational pilot project involving numerous central bank digital currencies (CBDCs) has been declared a success by the Bank for International Settlements (BIS), a consortium of the world’s central banks based in Basel, Switzerland.

According to a LinkedIn post, the BIS describes the trial as being a cooperation between central banks from China, Hong Kong, Thailand and the United Arab Emirates. From 15 August to 23 September, 20 participating commercial banks used the mBridge ledger to issue over US$12 million in value and facilitate over 160 cross-border payments and FX transactions, which totalled more than US$22 million.

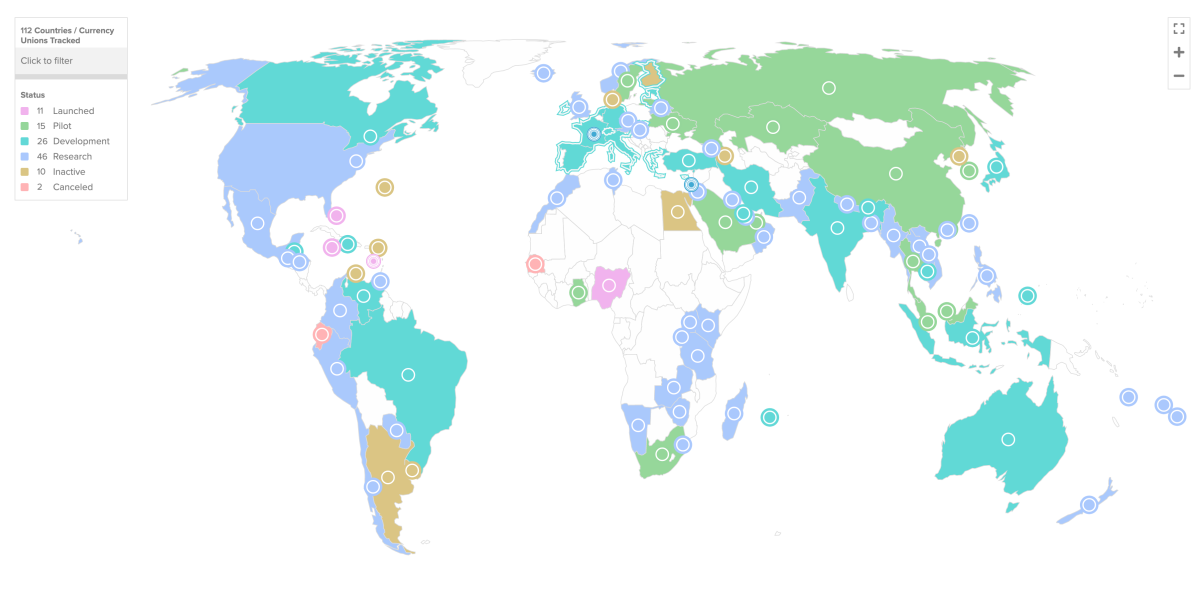

According to the Atlantic Council’s CBDC Tracker Tool, 105 countries representing 95% of the world’s GDP are exploring a CBDC in some capacity. To this point, many jurisdictions want to ensure that costly cross-border payments can be made both fast and properly secure. A more detailed report of the trial will be released in October, added the BIS.

US experience

In America however, the verdict regarding a CBDC wasn’t so positive. Shutting down any expectations, the chair of the US Federal Reserve, Jerome Powell said that the US will not come to a decision concerning a digital dollar any time soon.

“At the end of the day, we will need approval from both the executive branch and Congress to move ahead with a central bank digital currency,” he said.

“We see this as a process of at least a couple of years,” Powell added, specifying a time frame.

On September 8, Powell told the US-based policy think tank Cato Institute that the Fed’s conception of a digital dollar is being guided by four main principles.

According to Powell, an American CBDC must protect privacy, move through major intermediaries in the existing financial system, be widely transferable, and use some form of ID verification to nullify money laundering.

Aussie CBDC pilot kicks off

Earlier this week, the Reserve Bank of Australia (RBA) announced a furthering of its CBDC pilot program, which has invited domestic businesses to further develop use cases for its CBDC. While legal specialist Liam Hennessy praised the pilot program for its “limited scope” in a conversation with The Chainsaw, Finder co-founder Fred Schebesta took issue with the RBA’s minimal framework.

Schebesta said that the RBA’s small scope didn’t prioritise cross-border payments, something he believes to be the superior use case.

“Only having Australian entities and residents in the pilot will limit its use cases and value to consumers. International settlement is probably one of the best use cases,” he said.

Overall, the introduction of a CBDC in Australia is being viewed positively by legal experts and industry leaders, with Hennessy saying that a CBDC will work to reduce the costly operating systems of existing payments infrastructure.

“CBDCs are much cheaper to operate than our existing payments infrastructure. There’s a nonprofit nature of the RBA, so you’re not going to be paying for all the payments infrastructure that currently exists,” he said.

“Giving access to CBDCs, for people who want to access and use the payments infrastructure, is a really good one,” added Hennessy.