At the end of 2020 the cryptocurrency market surged, sending the prices of assets like Bitcoin (BTC) and Ethereum (ETH) rocketing to new all time highs. As massive sums of money poured in the sector, crypto tech startups hired aggressively, planning on building the new world of digital finance at breakneck pace. Now, the broader crypto industry has been forced into the unfortunate position of executing substantial layoffs in the wake of worsening market conditions.

Crypto Layoffs: Why are crypto companies laying off employees?

In the waning hours of 2021, things took a sudden turn for the worse in cryptoland. Bitcoin, which had surged to reach a new all-time-high of US$69,044 on November 10 of that year, fell steeply and suddenly. Unfortunately for many of the crypto firms who’d placed some hefty bets on the continual gains of crypto prices, the market is yet to show any major signs of reversal.

Declining asset prices haven’t been the only cause for concern in the world of crypto business. 2022 was a record year for industry blowups and meltdowns. Following the slew of high profile collapses of crypto companies like Do Kwon’s Terra Money, crypto hedge fund Three Arrows Capital and most notably FTX, the industry has been hit where it hurts.

It can difficult to get a lay of the land in the sleepless world of crypto, so here’s a breakdown of all the Australian crypto firms who’ve cut back on staff since the bear market began.

Crypto Layoffs: Immutable: cut 11% of staff in February 2023

In March last year, Immutable secured US$200 million in a Series C fundraising round led by Temasek, and followed by other investors including Animoca Brands and Tencent, bringing the valuation of the company to staggering US$2.5 billion. This enormous valuation saw Immutable become one of the most successful Web3 startups in the international crypto ecosystem.

Yesterday, the Web3 gaming firm, whose stated aim is to bring the “next billion” gamers into Web3, made a reasonable reduction in the number of staff, cutting its workforce by 11%. Immutable told The Chainsaw that this would impact the jobs of 30 people and see the elimination of roles “across various areas of the businesses — impacting both ImmutableX and Immutable Game Studio.”

This isn’t the first time the company has cut back on staff. In July, Immutable founder Robbie Ferguson delivered staff news that 20 jobs would be cut — approximately 6% of the workforce at the time.

Speaking to Startupdaily, Immutable said that while the relatively smalls cutback were necessary, there was still an overall plan to create more than 200 new jobs as the firm continued to hire, “aggressively in Immutable Studios, Gods Unchained, Guild of Guardians and Immutable X. We are actively increasing hires across product, engineering and tokenomics in Gods Unchained as we focus on scaling it to mainstream and beyond.”

Swyftx: two major rounds of layoffs and a ‘de-merger’

On December 5 2022, the Australian cryptocurrency exchange SwyftX announced that it would lay off 40% of its total workforce — roughly 90 employees — due to the ongoing decline in digital asset markets brought about by the sudden implosion of Bahamas-based crypto exchange FTX.

This wasn’t the only round of layoffs for Swyftx.

In late-August the exchange fired an additional 74 employees, cutting its workforce by 21% at the time. Speaking to the August layoffs, Swyftx co-CEOHarper explained that the move was made to “stabilise” the costs of the business amidst a sliding market.

Notably, Swyftx was also forced to walk away from a US$1.5 billion merger deal with share trading platform Superhero. While many firms, including Swyftx itself, had pointed to the string of collapses that permeated the sector last year as a reason for their downsizing, Harper claimed that the de-merger had little to do with the financial fallout stemming from FTX, nor the decline in crypto asset prices.

Instead, Harper insisted that increased aggression from regulators towards the crypto industry was to blame.

“The policy environment has changed significantly since we announced the merger and neither party has been able to realise the vision of the merger in any meaningful way,” Mr Harper wrote.

Digital Surge placed into voluntary administration

Just 4 days after Swyftx announced their round of sweeping layoffs, a Brisbane-based cryptocurrency exchange called Digital Surge was forced to call in the administrators and entered into voluntary administration.

Administrators at KordaMentha — the same firm overseeing the wind down of FTX Australia — were appointed to pick through the rubble of the beleaguered exchange on Thursday.

Customers have been barred from accessing their funds on the platform, with the company having suspended withdrawals and transfers from over 30,000 accounts in late November. The exchange’s new administrators confirmed that Digital Surge had about 30,000 clients and had been offering them trading services across more than 300 cryptocurrencies.

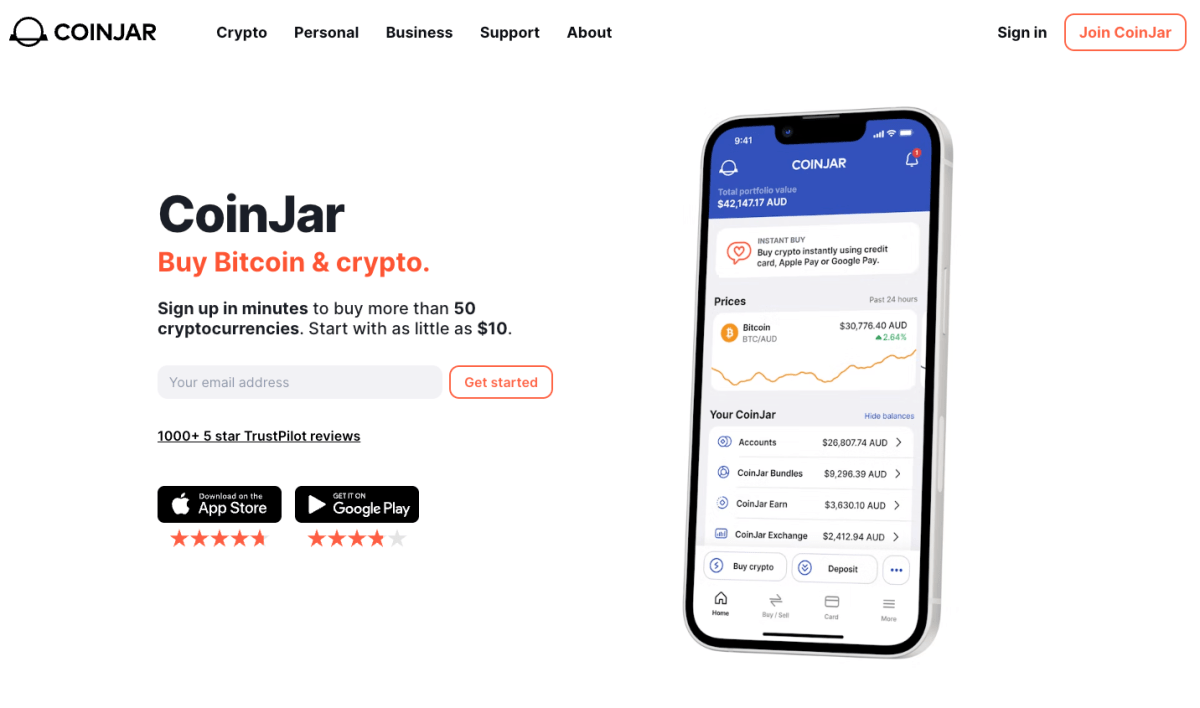

CoinJar cut staff by 20% in December 2022

Aussie crypto tech firm CoinJar, which pioneered the Australian crypto exchange sector more than a decade ago joined the growing ranks of crypto tech firms forced to cut back in December last year, roughly around the same time as Swyftx and Digital Surge.

Approximately 10 staff — roughly 20% of overall headcount — of the Melbourne-based fintech company were let go.

Like nearly everyone in the sector, CoinJar was pushed to downsize after it revealed that it held “a small account balance with FTX to facilitate our OTC trading desk operations and client trades” Notably, the amount represented less than 1% of the companies gross assets and didn’t include any customer funds, but the impact on the broader crypto economy resulting from the fallout of FTX was still apparent.