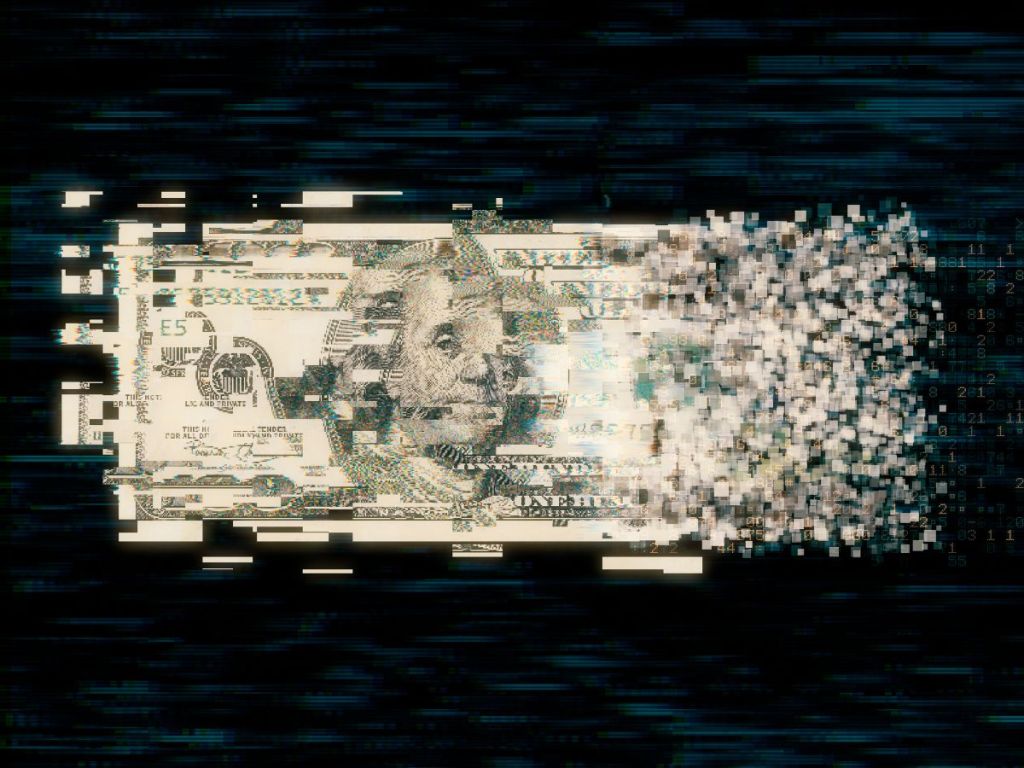

Exchange Reserves: This year has undoubtedly been one for the record books as far as crypto bear markets are concerned. Through various bankruptcies and the now infamous collapse of FTX, users are increasingly looking at crypto exchanges for greater transparency across the board.

One such area that has emerged front and centre in the transparency debate is composition of exchange reserves. Which are the various digital assets that major crypto exchanges are exposed to, and what are the implications, if any?

Proof-of-Reserves v exchange reserves

To clarify, exchange reserves are entirely distinct from Proof-of-Reserves (PoR).

Whereas the former relates to the digital assets being held by the exchange for its own balance sheet, the latter refers to a mechanism for demonstrating that user deposits are matched 1:1 with assets held by the exchange on their behalf. Still a bit confused? Let’s dig in a bit deeper.

Proof-of-Reserves 101

PoR seeks to introduce transparency to exchanges reserves through a verifiable auditing process using cryptographic proofs, public wallet addresses and periodic third party audits to public attest that an exchange holds sufficient assets to match users deposits.

In other words, if you logged on to the exchange and saw 10 BTC, you should actually be able to withdraw 10 BTC. At all times, user deposit balances should match the assets being held by the exchange on a 1:1 basis.

That’s PoR in a nutshell and in 2022, many exchanges rushed to provide PoR in an attempt to earn user trust. As a further attempt to provide transparency, many exchanges released information on their exchange reserves, namely the composition of digital assets held by the exchange for its own account (and not on behalf of users).

Composition of exchange reserves

According to recent data from on-chain analytics and data provider Crypto Quant, there are distinct differences between the reserve composition for each of the largest global crypto exchanges.

Given that Bitcoin (BTC) and Ethereum (ETH) are the most well-known, least volatile and most valuable two crypto assets comprising close to 60% of total crypto market capitalisation, Crypto Quant limited its analysis to them.

Importantly, they did not include the split between BTC and ETH holdings, nor did they include any stablecoins or fiat currency in the exchange reserves.

With that said, here is what they found:

While some like Bifinex (91%), Kraken (75%) and Coinbase (63%) had a large portion of their holdings in BTC and ETH, others took a completely different approach by having only a small portion of their exchange reserves in the flagship assets. These include Huobi (22%), KuCoin (19%) and Binance (15%).

That’s the exchange reserves composition, so what?

As a starting point, it’s important to remember that those exchange reserves tell us little about the financial health of the exchange. The reason is because it doesn’t address the question of liabilities (i.e. debts) and unless the company is publicly traded, you won’t get that information.

What it does however reveal is the extent to which some exchanges have gone further out on the risk curve by holding other digital assets on their own balance sheet. Broadly speaking, BTC and ETH are viewed as the least risky digital assets, at least outside of stablecoins.

Accordingly, all things equal, exchanges that have higher proportions of BTC and ETH as their exchange reserves have adopted a more conservative treasury strategy. Again, this says nothing of their cash flow position or any off chain liabilities that would otherwise be relevant in determining the exchange’s financial health.

Take for example Binance whose own BUSD and BNB token comprises over 40% of its exchange reserves. In fact, the exchange holds a large position in both BNB and BUSD worth close to US$30 billion. What happens if BUSD depegs or if the market loses faith in BNB? Undoubtedly, Binance’s exchange reserves would take a major knock.

By contrast, other exchanges like Bitfinex would be far less vulnerable to those sorts of significant drawdowns, given that over 90% of its reserves are in BTC and ETH, neither of which are its own proprietary stablecoin or exchange token.

Clearly, there is no single strategy that is appropriate for all exchanges. Equally clear is the fact that some exchanges have elected to pursue a far riskier treasury strategy than others – see Binance.

Risk however is a double-edged sword that in 2022 proved to offer more downside risk than upside. Arguably when the bull market eventually returns, the inverse may be true.